A quick guide to VAT when you’re self-employed

As a self-employed business owner, there’s a lot you need to know about accounting to keep your records accurate and your cash flow moving. Once you hit a minimum threshold of annual taxable turnover, that includes charging Value-Added Tax (VAT).

In this article, we’ll look at what VAT is and how it works. We’ll also cover what you need to know about becoming VAT registered and charging and reporting VAT when you’re self-employed.

Table of contents

- What is VAT, and how does it work for self-employed entrepreneurs?

- Do I need to register if I’m self-employed?

- Charging VAT as a self-employed business owner

- Reporting and paying VAT to HMRC

- Do I need to charge VAT on goods and services I sell outside the UK?

- Wrapping up

What is VAT, and how does it work for self-employed entrepreneurs?

If you’ve ever bought something, you’re likely familiar with Value-Added Tax, or VAT. It’s a flat tax on the price of a product or service, similar to a sales tax. But unlike sales tax, it’s paid at each stage of manufacturing, distribution or sale.

VAT-registered companies invoice and pay tax on all the VAT taxable (or VATable) goods and services they buy or sell, and then pass that cost on to their consumers. They then file regular VAT tax returns and either reclaim the VAT they’ve been charged by other businesses (if what they’ve paid is more than what they’re charging to customers), or pay the government what they owe (if the opposite is true).

Depending on your taxable turnover and preferences, the process of collecting and paying VAT can apply to your self-employed business as well. Here’s what it looks like.

How is VAT paid?

Both individual consumers and businesses pay VAT on any taxable goods or services they purchase. That means raw materials for manufacturing, professional services or office supplies—anything you buy to keep your business running. And if you qualify or choose to voluntarily become VAT registered, it means you also charge VAT on the products or services you sell.

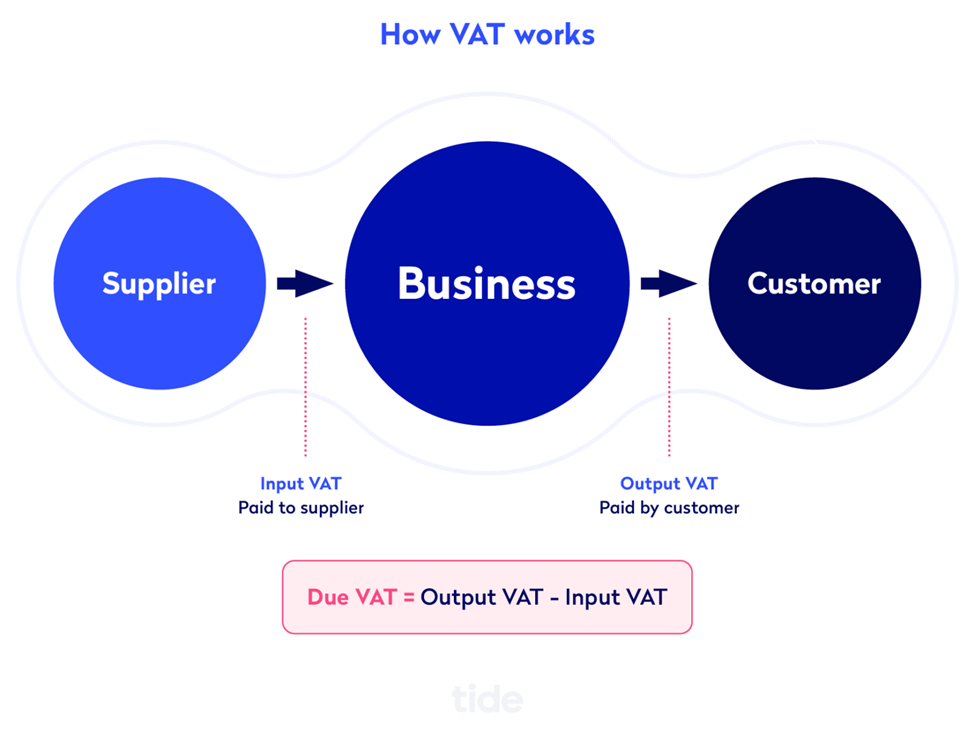

If your suppliers are VAT registered, the tax they charge you is called input VAT. And if you’re registered, the tax you charge your customers is called output VAT. The VAT you eventually pass on to HMRC is the difference between what you paid and what you collected. Visually, the relationship looks like this:

Do I need to register if I’m self-employed?

Self-employed people, including freelancers, are subject to the same rules as any business when it comes to being VAT registered. If you meet certain criteria, you’re required to register and begin charging VAT.

You may also benefit from registering even before you’re technically required to. Here’s how it works.

When and how to register

All businesses (including self-employed businesses) must register for VAT once they reach a certain earning threshold. In the UK, it’s when you make sales over £85,000 in a year.

Once you cross that threshold, you must register for VAT within 30 days of the end of the month in which you did so. This is called the backward look.

For example, say you received a payment that pushed you over the threshold on 5 October (meaning you have now sold more than £85,000 worth of goods or services since last October). You now have until 30 November to register for VAT.

The same goes for if you crossed that threshold on the 28 October. You have until 30 November to register for VAT.

You must also register if you predict your sales will cross the minimum threshold. This is called the forward look.

If you expect your sales will cross £85,000 within a year, you must register within 30 days from the date you discovered this. This often happens when you land a deal that will push you over the threshold when payment is complete.

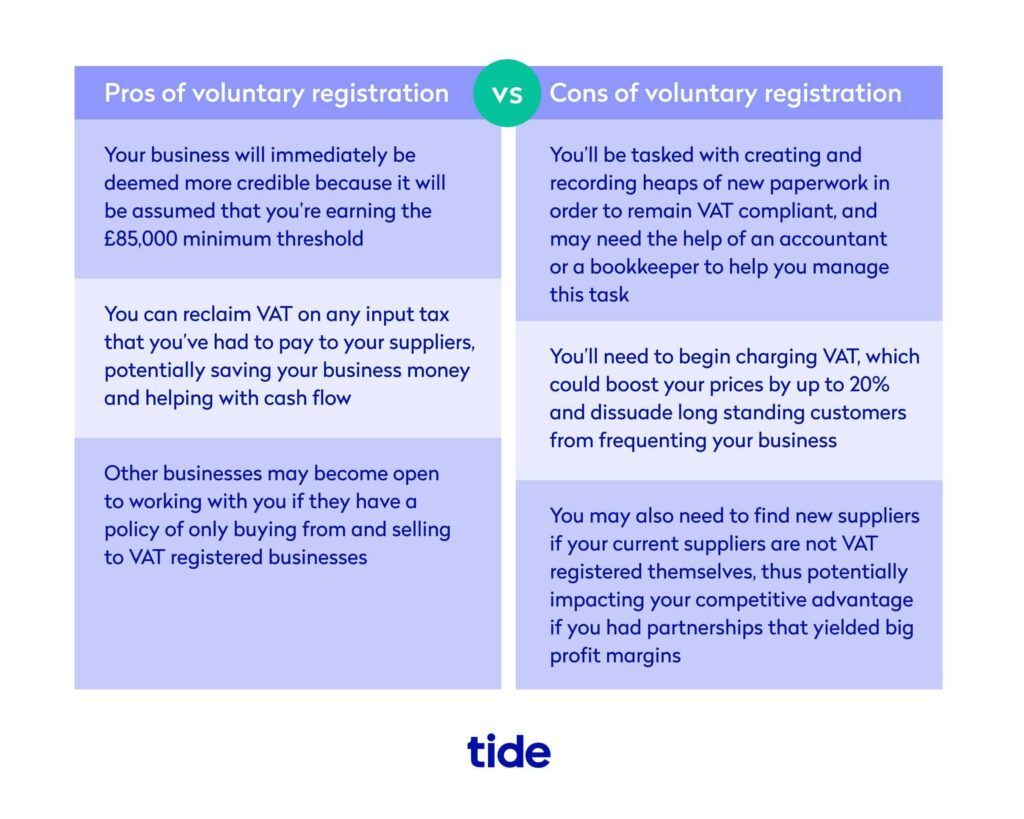

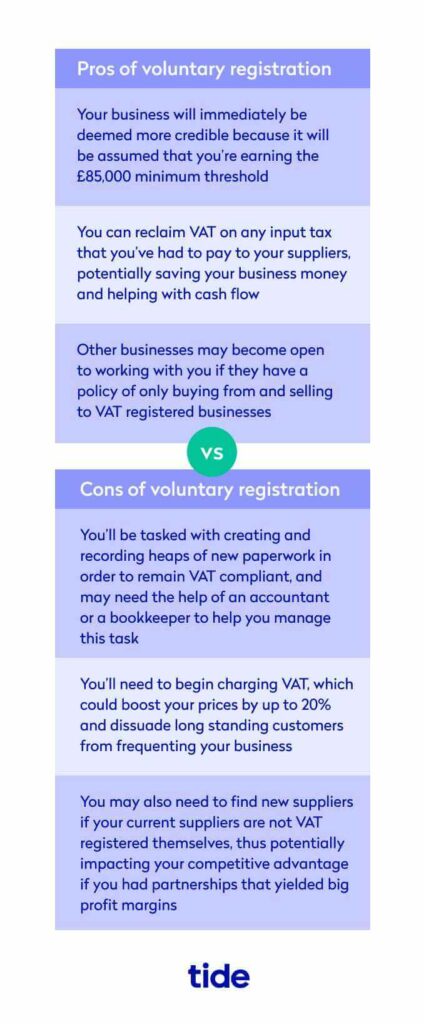

You can also register voluntarily even when you haven’t reached the earnings limit. There are many benefits and drawbacks to registering voluntarily for VAT.

In the pro column, VAT registration makes your business appear more credible, as others will assume you’re earning revenue above the VAT threshold. It’s also useful if you are charged VAT from suppliers and are eager to reclaim it.

In terms of cons, you’ll need to begin charging your customers VAT, which will likely boost your prices by 20%. This could upset loyal customers that are used to set prices, as well as businesses that you supply goods to (if applicable). It also increases the amount of paperwork you need to file throughout the year, which can take up valuable time and resources.

Whether you choose to register voluntarily or because you’ve hit the threshold, the process is the same.

You (or your agent or accountant) can register your business for VAT at GOV.UK. The date in which you hit your backward look or forward look date is known as your Effective Date of Registration (EDR).

Once registered, you begin charging VAT to your own customers and paying the tax on to HMRC regularly.

Benefits of VAT registration when you’re self-employed

There are quite a few advantages to being VAT registered. As mentioned above, companies may elect to register before they even hit the earnings threshold.

Here are a few reasons you could benefit from being registered as a sole trader.

1. You reclaim VAT paid on business purchases

Even if you’re not charging VAT, it’s likely some of your suppliers are. When you register, you’re eligible to claim that expense back on your VAT returns. You report both what you pay and what you charge in VAT for each return. As long as what you charged customers is less than what you paid suppliers, you can reclaim the difference on your return and receive a refund.

2. You’re protected from penalties for crossing the VAT threshold unaware

If you’re not careful, you might exceed the registration threshold without realising it. If this happens and you fail to register by the designated deadline, HMRC will extend a penalty fine for failing to comply with the VAT requirements. If you’re close to reaching that milestone, voluntarily registering can protect your business from costly penalties.

3. You boost your company’s reputation

If you’re in a competitive market, being VAT registered can help you stand out by building your company’s brand. Displaying your VAT registration number on your marketing materials and website and charging VAT on invoices shows that you’re a reputable and successful business. You’ll enhance your professionalism by showing that you trade as a well-established business entity.

Top Tip: Learn about the consequences of late registration and how to officially register in our guide on what happens when you charge VAT before you’re registered⚡️

Charging VAT as a self-employed business owner

You must charge the correct rate of VAT, especially if you want to reclaim some of your VAT. That means knowing what to bill for goods and services and documenting the charges on your invoices. Here’s what you need to know.

How much should I charge?

Certain goods and services are exempt from VAT and cannot be taxed. These are things that serve the public good, so the government wants to keep them affordable. These include goods and services supplied by charitable organisations, energy and medical service providers, education vendors and finance, insurance and investment service providers.

Everything else is subject to VAT tax, and you need to know what to charge. There are three different VAT rates for companies in the UK:

- Standard rate (20%). This applies to most goods and services. You should charge this rate for any non-exempt sales that don’t qualify for reduced or zero rates.

- Reduced rate (5%). This lower rate applies to some goods and services like household energy and children’s car seats.

- Zero rate (0%). This applies to many essentials. These include food (excluding restaurant meals), children’s clothing, books and newspapers, prescriptions and new house sales. Note that while you don’t charge tax on zero rate goods, they differ from exempt goods because you can still claim VAT credit for them on your return.

The table below outlines the percentages you charge for each rate. For more on which VAT rates and requirements apply to your business, visit GOV.UK.

| Rate | % of VAT | What the rate applies to |

| Standard | 20% | Most goods and services |

| Reduced rate | 5% | Some goods and services (e.g., children’s car seats and home energy) |

| Zero rate | 0% | Zero-rated goods and services (e.g., most food and children’s clothes) |

Invoicing with VAT

The VAT you pay to your suppliers is recorded on the invoices they send you. And to reclaim VAT, you must include a record of the tax you charge on the invoices you send to clients.

Good VAT record keeping is of the utmost importance. HMRC will issue penalties for poor record-keeping (intentional or not), and this includes your VAT invoices.

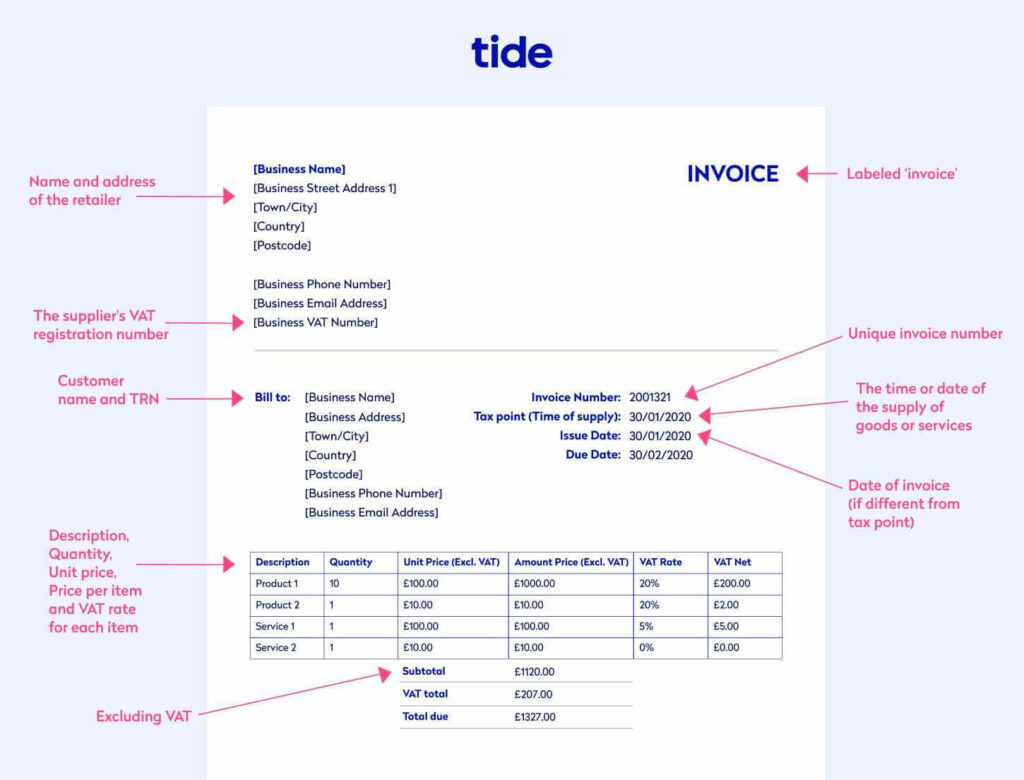

VAT invoices can fall into three categories: simple, full or modified. The most common is a full VAT invoice, which includes the following information (in addition to that found on a standard invoice):

- Your VAT registration number

- The unit price for goods and services, excluding VAT

- VAT charged per item

- The total charge excluding VAT

- The total amount of VAT charged

Here is an example of a full VAT invoice:

Reporting and paying VAT to HMRC

To keep in good standing and both pay and reclaim VAT, you must know when and how to file returns. Here we’ll go over the basics of submitting returns, which VAT scheme you should be using and how Making Tax Digital affects your returns.

Submitting VAT returns

You’re required to keep a record of the VAT you charge and pay in a separate VAT account that you’ll use when you file your returns. This is an important piece of accounting that you’ll maintain throughout the year to make sure your returns are accurate.

Top Tip: Accurate and up-to-date VAT records are crucial to successfully filing your returns. But even with your best efforts, mistakes can occur. Reduce your chances of having to amend your records by reading our guide on how to avoid and rectify common VAT mistakes⚡️

When to submit returns

You report VAT to HMRC by filing a VAT return every accounting period – usually quarterly. It’s up to you to choose when your quarterly period starts when you first register for VAT.

Returns and payments are due one month and seven days after the end of every accounting period. That means that if your accounting period ends on 31st March, for example, your return is due no later than 7th May.

Note that if you owe money, it must also be in HMRC’s account by this deadline. So plan to submit your return and make the transfer a little in advance to avoid missing it.

How to submit returns

For most companies, returns should be submitted through your online account. Once you’ve registered and received your VAT number from HMRC, you can sign up for a VAT online account. From there, you’ll be able to see your deadlines and submit returns.

The information you’re required to report in your return includes:

- All your sales and purchases for the quarter

- The VAT you owe

- The VAT you can reclaim

- The amount of your VAT refund due from HMRC

Top Tip: When reporting VAT on your return, you need to include VAT codes that indicate how much was charged and the type of good or service sold. Prevent mistakes by checking out the full list of commonly used VAT codes and how to use them in our complete guide to VAT codes 📌

Different VAT schemes to choose from

Depending on the type of business you own and your yearly sales, you may be eligible to choose a simplified VAT scheme.

HMRC designed three alternative schemes to help small businesses that may be adversely affected by the standard VAT scheme. They allow you more options regarding how you pay and charge VAT to other businesses and customers. And they give you the flexibility to manage your cash flow better over the year.

The table below outlines the main schemes you can choose from as a self-employed business. You can get details of all the ways to account for VAT on GOV.UK.

| Scheme | Eligibility | Important points |

| Flat rate | Your expected VAT turnover is less than £150,000 (excluding VAT). | You charge the standard rate but pay a fixed VAT rate based on a percentage of your sales. You keep the difference between what you charge customers and what you pay HMRC. You don’t claim back VAT on your purchases other than capital assets over £2,000. |

| Cash accounting | Your expected VAT turnover is less than £1.35 million. | VAT is calculated on each sale. You only pay when your customers pay you. And you only reclaim VAT once you have paid your suppliers. |

| Annual accounting | Your expected VAT turnover is less than £1.35 million. | You make advance VAT payments throughout the year but only submit one VAT return annually. When you submit your return, you either pay the difference between your total advance payments and your actual VAT bill or claim a refund if it turns out you’ve overpaid. |

Advantages of each scheme

Flat rate VAT scheme: You don’t have to keep a record of the VAT you charge on each sale. You simply calculate VAT payments as a percentage of your total business turnover.

Cash accounting scheme: Cash accounting helps control cash flow as you don’t pay until you get paid. But it can get tricky if you buy on credit, as you also only claim the VAT back after you pay the debt.

Annual accounting scheme: You control cash flow as you make smaller payments throughout the year. However, this scheme may not be a good choice for those who prefer regular VAT repayments.

How Making Tax Digital affects your return

Recently, HMRC started requiring most businesses to file VAT returns online in what’s known as their Making Tax Digital (MTD) scheme. It requires eligible businesses to use compatible software to keep digital business records and file VAT returns online.

Tide Accounting is our very own MTD-compliant accounting software. It’s designed to let you handle your bookkeeping and accounting alongside your business banking, in one account – so accounting becomes simple and secure, the way it should be. Open a Tide account today to get started.

Who has to register?

All businesses required to register for VAT must sign up for MTD. Those who are voluntarily registered will be required to sign up by April 2022. Only those who are exempt may avoid signing up.

Who’s exempt?

Anyone who meets any of the following three criteria is exempt from MTD.

- It is not “reasonably practicable” for you to use digital tools to keep your business records or submit your VAT returns. This may be due to reasons like age, disability or location.

- You or your business are subject to an insolvency procedure.

- Religious beliefs of everyone running your business forbid using electronic communications or keeping electronic records.

HMRC will consider every application on a case-by-case basis. To apply, you’ll have to either call or write to HMRC to share the reason you think you’re exempt. You can check whether you’re already exempt or get details on how to claim exemption on GOV.UK.

Do I need to charge VAT on goods and services I sell outside the UK?

If your business is based in the UK, you may need to charge VAT on sales outside the UK depending on what you sell, who you sell to and the total of all your taxable sales.

Goods sold to customers outside the UK, and goods and services sold outside the EU, are generally zero rated, so you don’t charge VAT on them (though you must still report on it as zero rated is not the same as exempt). But when it comes to services, you need to consider the following.

Rules for VAT on services sold to EU countries

Whether you charge VAT on services depends on if you’re selling to other businesses or individual consumers. For UK VAT purposes, you treat the customer as a business if they have a VAT number. If they don’t have a VAT number, even if they are a business, you treat them as a non-business consumer.

You also must consider what’s known as “place of supply” in determining whether to charge VAT and how much to charge. If you’re selling physical goods, the place of supply is the UK, and you charge VAT according to those rules.

If you’re selling services to non-business consumers, the place of supply is also the UK. But if you’re supplying services to business consumers, the place of supply is the consumer’s country. Therefore you adhere to the VAT rules of that country.

Learn more about types of consumers and place of supply at GOV.UK.

Reverse charge

When the VAT belongs to another country, you account for it using a reverse charge. That is, you don’t charge VAT, but the customer instead charges themselves VAT according to their country’s laws. You indicate this on your invoice by including the customer’s VAT number and a note like “Reverse charge applies to this transaction”, so you have a clear record for your VAT return.

Learn more about the reverse charge at GOV.UK.

Wrapping up

Understanding your VAT responsibilities and advantages as a self-employed business owner is crucial to maintaining healthy finances. There are many moving pieces and extra paperwork involved, but with planning and regular record keeping, you can easily manage your VAT returns.

Using accounting software to help you maintain your VAT records will make reporting your returns easier and quicker. You can save time and frustration by automatically importing income and expenditures, and rest assured that calculations are correct.

Photo by Thirdman, published on Pexels