How to Raise Venture Capital: 6 Tips to Fund Your Startup

There are several ways to fund your business, but raising venture capital (VC) is one of the best ways to accelerate growth and gain industry guidance.

However, raising capital can be a major challenge and can take up to six months to secure, and even longer to be notified of a rejection. The last thing you want to do is neglect growing your business and focus all of your time and energy on procuring VC, only to hear “no” and watch your business go under.

Understanding best practices is key. In this article, we’ll cover the stages of venture capital funding and go over best practices for successful fundraising. We’ll also talk about how to secure investor meetings and share tips for creating the perfect pitch deck to help you win capital investment.

Table of contents

- Understanding the stages of venture capital financing

- Best practices: How to raise venture capital funding

- 💡 Expert insights

- 📹 Masterclass video: How to approach investors to fund your business

- Wrapping up

Understanding the stages of venture capital financing

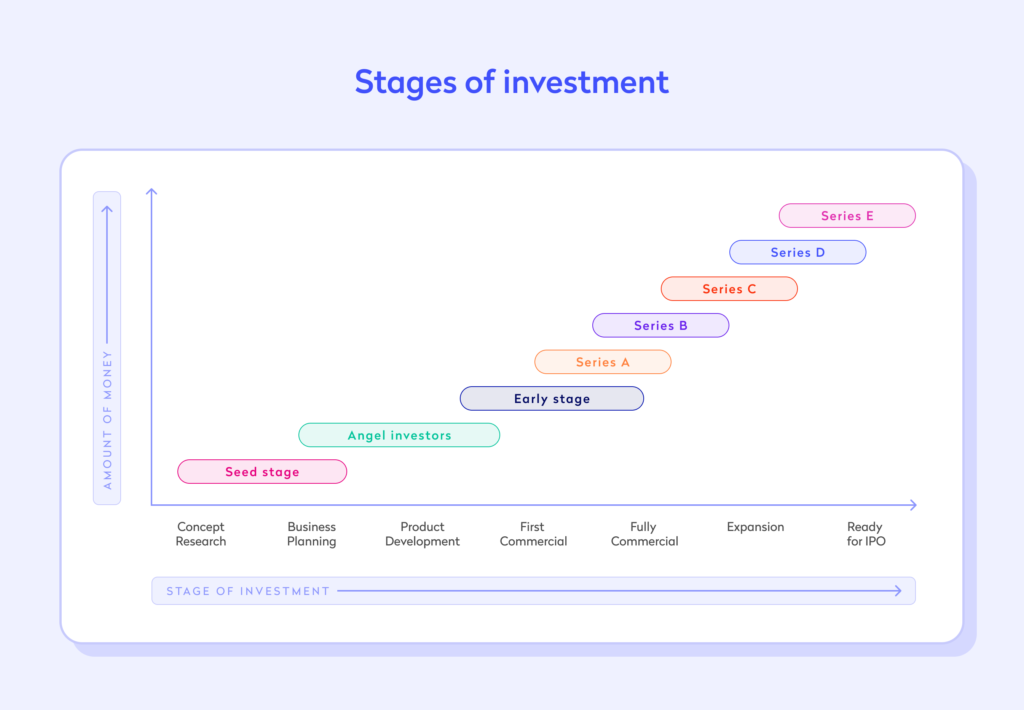

Raising venture capital funding will look different for each company, but in general, each startup will go through common stages. Before we get into how to raise venture capital funding, let’s look at what you need to know about these stages.

Is seed funding the same thing as venture capital?

Seed funding and venture capital are both private investments in exchange for equity. However, when raising seed funding, you’re asking for a significantly lower monetary amount compared to venture capital—tens to hundreds of thousands of pounds vs. millions, respectively.

Therefore, while seed funding falls under the venture capital umbrella, consider it your first step of many in seeking funding in exchange for equity.

Seed funding is meant to help get your business off the ground or keep it afloat, while venture capital is meant to drive growth. Seed investors are often individuals, while venture capital usually comes from institutions.

Ultimately, seed funding helps you raise money to conduct market research, hire a team and develop products or services, whereas venture capital funding helps you broaden your reach.

Pre-seed funding exists as well, but this unofficial funding round is often not in exchange for equity. Pre-seed funding is meant to add to your initial out-of-pocket funding (if you choose to bootstrap your new business) and pre-seed funder’s aim to provide intensive guidance and support.

That said, pre-seed VC is starting to become more common, with companies like Seedcamp eager to invest in what they consider to be winning ideas.

Seedcamp, for example, offers £150-180K usually in exchange for 6.5% ownership of your business in a pre-seed round and “provide you with everything you need to get off the ground”. Pre-seed VCs are interested in partnering with potential future unicorns before anybody else has a chance to hop on the bandwagon.

Here are some examples of pre-seed and seed funding opportunities.

- Friends and family investors: Before looking for venture capital, you can ask your network of family and friends if they’re interested in helping finance your business. Friends or family members typically invest somewhere between £10,000 and £150,000 of their personal finances into your business without taking any equity. While this pre-seed activity is less formal than other fundraising processes, you should still carefully document each investment to help stay organised and maintain clarity.

- Incubators and Accelerators: Incubators are helpful when you have a great idea but don’t yet have a proven business model. Incubators will support your startup with mentorship, expertise and an environment that helps nurture your business to the market. Accelerators come into play after you’ve proven your business model but still need help getting to market efficiently and quickly. Incubators often don’t provide investment capital, whereas accelerators often do in exchange for equity.

- Angel investors: Angel investors, or private investors, are typically people, a syndicate or small entities with a high net worth that provide financial backing for entrepreneurs or new small businesses. Angels often invest between £100,000 and £2 million in an early-stage company. Typically, angels will request equity in your company in exchange for their investment. Because it’s risky, angels often expect a higher rate of return than late-stage investors. Angel investors also often provide mentorship support as they are invested in helping you grow. Angel investors fall into the “early VC” category.

- Early-stage VCs: These are investors, like the above mentioned Seedcamp, who are interested in backing world-class opportunities before anybody else even knows who you are. Usually, early-stage VCs are only interested in potential unicorns or the next big thing.

Top Tip: Learn more about seed funding and other ways to get your business off the ground, such as startup loans, bank loans, crowdfunding, or bootstrapping, in our guide on 10 ways to fund your small business 💸

What are Series A, B and C funding?

These are the consecutive rounds of funding that take place after seed funding. The series label refers to the class of preferred stock sold.

While these rounds often take place in order, it is possible to bypass some of them if you have a brilliant idea that garners substantial interest. For example, “unicorns”, or startups with a valuation of over 1 billion, often skip traditional investment rounds because of how high their valuation is so early on in their startup journey.

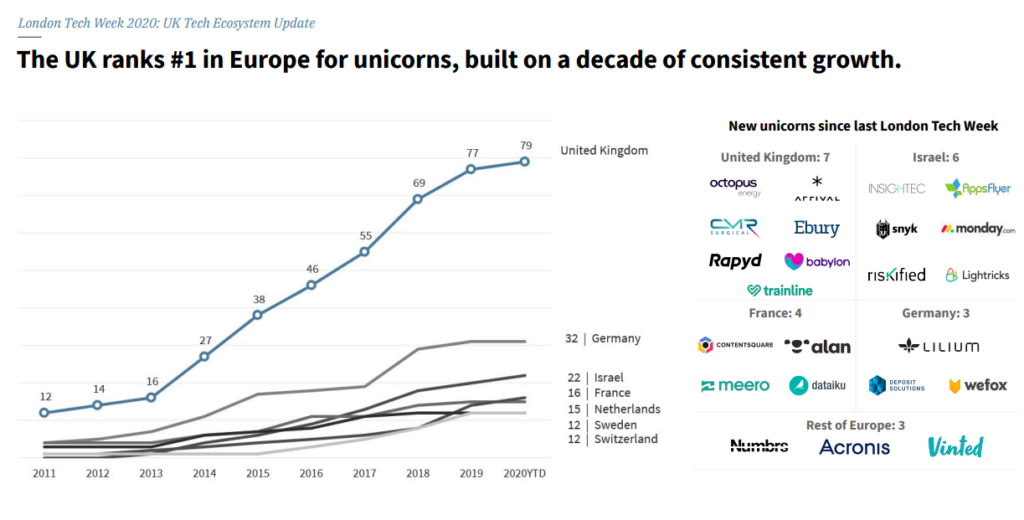

In the UK, 2020 was a record year for unicorns, and it ranks #1 in Europe for most unicorns.

Most companies proceed through these rounds in order. But it’s not necessary to complete all of these rounds—if you raise enough capital to steadily grow after the seed funding or Series A rounds, you can stop. You can even go beyond Series C to Series D or E, but that’s uncommon as most companies usually raise what they need by the end of series C.

One of the key distinctions between these rounds is your business’s valuation. Valuation is the current worth of your business and is calculated by looking at your proven track record, market size, management competency, maturity level and growth prospects.

Before you can figure out your valuation, you need to decide how much money you want to raise and how much of your company you’re willing to sell. If you choose the former, you should plan to raise enough to last between 12–18 months before you need to either raise more or earn enough revenue to stay afloat. If you choose the latter, know that founders typically sell 10% and 20% of their equity in seed or early-stage rounds.

It’s a good idea to see how much your competitors have raised to get a better idea of how to create your own valuation. Sites like Tech Nation and Crunchbase are fantastic resources for finding data on other businesses, investors, and sectors. You can find information on how much they’ve raised per round and their respective valuations.

No matter which round you’re seeking investment in, it’s possible and probable to have many venture capital firms invest in your business each time. In all, these successive rounds represent your business maturing and growing.

Let’s examine each round in detail.

Series A funding

Businesses seek Series A funding or financing once they already have an established user base and consistent revenue. Series A funding is meant to help you further optimise your user base and product offerings as well as scale your product and introduce it to new markets.

Receiving Series A funding is a huge milestone for new businesses. Companies won’t receive Series A capital if they haven’t proved their minimum viable product (MVP), so winning this funding helps to further validate your business idea and model.

Typically, businesses in Series A rounds:

- Raise between £2 million and £15 million

- Have a valuation between £10M – £40M

- Pull in £100K to £250K per month in revenue

- Attract investors from traditional VC firms (but angel investors or equity crowdfunders can also invest in Series A)

Acquiring Series A funding is incredibly difficult because companies are taking a big risk of investing before you’ve fully proven your business model.

Series B funding

Series B funding is meant to help you significantly expand your market reach. At this stage, you’ve proven your business model, so it’s easier to establish trust with investors.

Series B funding helps you to expand your team, seek seasoned and experienced staff and scale your overall business development efforts. Businesses seeking Series B funding are ready to transition from an established company to a competitive force in their target market.

Typically, businesses in Series B rounds:

- Raise between £10 million and £25 million

- Have a valuation between £30M – £100M

- Pull in £350K to £800K per month in revenue

- Attract investors from traditional VC firms (but may also attract investment from firms that focus more heavily on late-stage funding)

Acquiring Series B funding is less difficult than Series A because you’ve already secured early-stage funding. This gives you social proof and proof of concept that helps to build trust with venture capitalists (VCs).

Series C funding

Series C funding is meant for successful companies looking to develop new products or services or further expand into new markets.

Series C funding can even be used to acquire other companies, which in turn will give you access to new tools and staff that can help you expand your offering and reach. A merger like this can give you the competitive advantage you need to significantly scale your business.

Businesses that procure Series C funding may also be looking to boost their valuation before going for an initial public offering (IPO).

Typically, businesses in Series C rounds:

- Raise between over £20 million

- Have a valuation of over £100 million

- Pull in over £1 million per month in revenue

- Attract investors from hedge funds, investment banks, private equity groups and traditional VC firms as well as the traditional venture capital firms in the previous rounds

By now, you’ve proven your business model so investment is less risky. Therefore, it’s relatively easy to procure Series C funding. Businesses that procure Series C funding may also be looking to boost their valuation before going for an initial public offering (IPO).

Best practices: How to raise venture capital funding

The following advice applies to seed funding as well as early-stage and late-stage (Series A, B and C) funding. Follow these best practices to give yourself the best chance to secure funding to drive business growth.

1. Prepare by identifying your needs

Start by creating a detailed business plan to figure out exactly how much investment you need and why you need it.

Knowing this will give you a better idea of whom to pitch to, how to frame your pitch and when to seek funding.

Top Tip: Ready to identify exactly how much funding you need to get your business started? Learn what startup expenses to plan for and how to calculate how much funding you’ll need in our guide on how much it costs to start a business in the UK 📖

This is not the same as the pitch deck that we’ll outline below, but keep in mind that parts of your business plan can be incorporated into the pitch deck you eventually create. Further, a detailed business plan can be delivered after your pitch to supplement your presentation.

As you create your business plan, you’ll be able to fill in the gaps regarding your business goals, target market, target audience, competitive landscape, product definitions and financial projections. These are all crucial aspects that investors look for when analysing your pitch and deciding your potential success rate.

Top Tip: Understanding your target market is essential to a strong business plan. To learn how to get a full picture of your audience to ensure your message and USP resonates, read our detailed guide on how to conduct market research for your business idea ⚡️

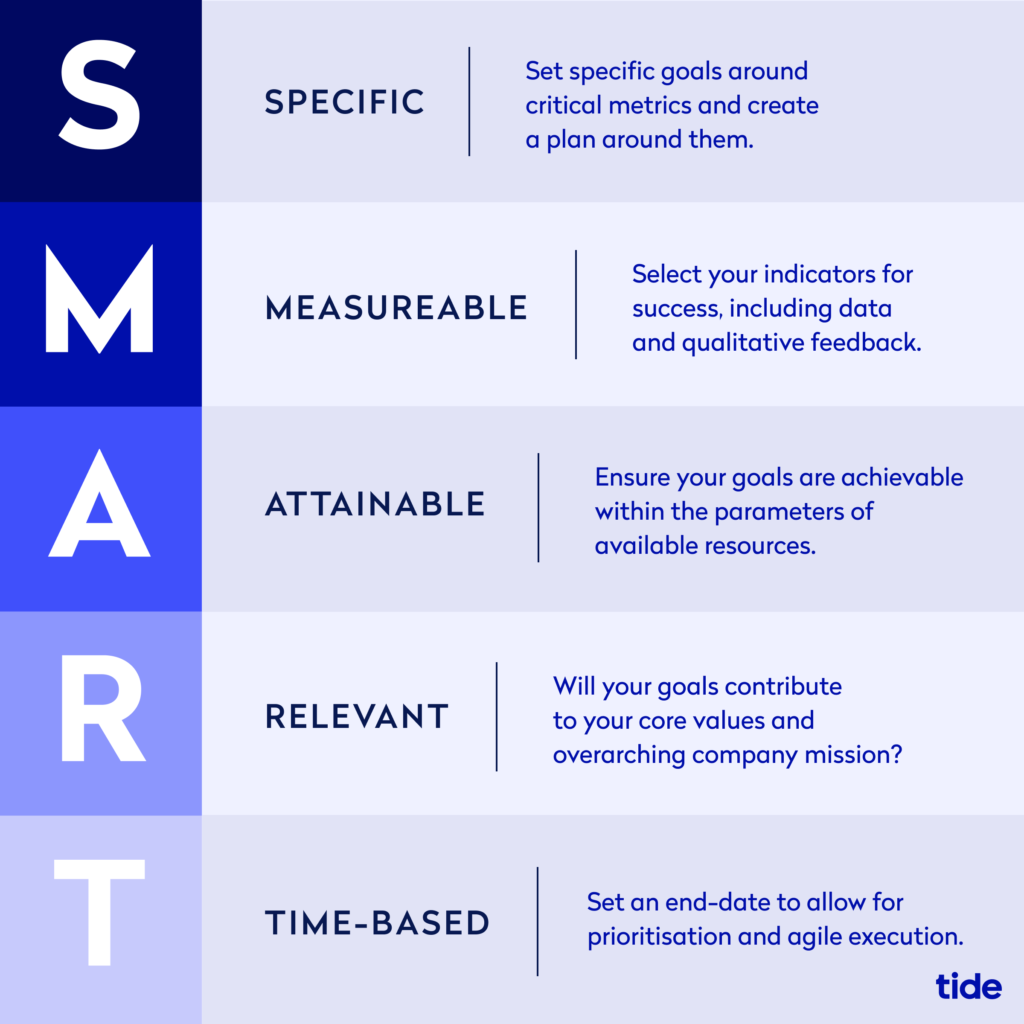

Finally, use the SMART goals method to identify your business goals and ensure they’re practical. SMART stands for: Specific, Measurable, Attainable, Relevant, and Timely.

If you’re seeking late-stage funding, make sure you update your business plan to match your current numbers, projections and roadmap.

Top Tip: To learn more about how a well-executed business plan can help your company grow past the startup phase, read our complete guide on how to create a business plan 💡

2. Research potential investors

Once you have a better idea of what your business stands for and how you’ll make money, it’s time to research potential VCs. This will give you a good idea of who’s looking to invest, what they’re interested in investing in, what pitches they typically hear and so on.

This research will help you get a better idea of:

- Your chances of procuring an investment

- If the investments on offer align with your business goals

Ideally, you’ll watch to find a list of VCs that specialise in your target market. This way, you’ll pull in industry guidance from seasoned experts who can help you steer your business in the right direction.

There are several great resources that can help you find more information about active investors, both in the UK and on a global scale.

- Tech Nation: Search by investor type, whether it’s a first time fund, preferred investment stage, location and activity history. They even have a matching tool that can help you find the right investors for your business.

- Crunchbase: A source for investors and investees on a global scale. Filter by location, industry, number of employees, total funding amount and last funding date. You can also conduct market research and follow trending profiles and recent news.

- Investor Hunt: Their paid version gives you access to a database of over 40,000 investors and 200,000 data points, whereas the free version allows you to dip your toe into a database of 4,000 investors. You can add advanced filters to your search, similar to the sites above, and even procure email addresses so that you can get in touch right away.

- British Venture Capital Association (BVCA): They provide a directory of venture capital firms operating in the UK. The information is only available for free to members, but non-members can purchase the directory for £125 for one year’s access.

Besides online investor databases, you can also do a quick google search for the top UK venture capital firms. Entrepreneur Handbook has put together a comprehensive list of UK VCs, complete with links to each top firm to help you get started.

Additionally, Crunchbase has collated the most active seed investors in Europe in 2019, broken down by pre-seed, accelerator, early- and late-stage rounds.

3. Network to build relationships

Forming relationships with venture capital investors, angels and industry peers will help you gain insight into who is looking to invest right now. Besides investment opportunities, networking helps you form a community of like-minded entrepreneurs and small business owners whom you can share ideas and collaborate with.

Plus, if you help other entrepreneurs and small business owners with their investing queries and provide guidance where you can, you may receive the same free and invaluable guidance if a time comes when you need it.

So, where can you meet these investors and peers to build these relationships? There are plenty of networking opportunities that take place throughout the UK and especially in London.

Networking opportunities in the UK

Here are some of the best networking events in the UK to meet angels and early seed investors. (Note: COVID-19 may have paused some of these events so double-check the time and place before committing.)

- Capital Enterprise is an organisation of experts that operate a number of seed funds. They host free networking events and workshops.

- Paradigm Talks host monthly informal gatherings meant to provide a space for entrepreneurs to pitch to VCs and angel investors.

- UK Business Angels Association (UKBAA) is a members-only angel and early-stage VC investment network that hosts many events throughout the month. It’s open mostly to investors, but it does occasionally have events open to entrepreneurs as well.

- Startupbootcamp Demo Days are accelerator networking events tied to SBC’s different programs. There are events for insurance and tech innovators and industrial IoT solutions. During their bootcamp events, startups participate in a range of workshops and investor relation networking events.

- British Private Equity & Venture Capital Association (BVCA) hosts premier events for private equity and venture capital. Their goal is to promote networking that builds long-standing relationships across the industry.

- TechHub, the global community for tech entrepreneurs and startups, runs over 1000 events per year that help entrepreneurs make new connections with peers and investors alike.

4. Hire an advisor for expert insights

If you feel you need more help after networking or searching on your own, an advisor can offer you advice on where to look for capital and how to structure your pitch. They can also introduce you to their network of VCs and angel investors who may be interested in hearing your idea.

In general, an advisor can also:

- Act as a broker or intermediary to help you negotiate the terms of your deal, which is extremely important if you’re raising capital for the first time

- Use their experience to help to accelerate the fundraising process

- Improve the terms and conditions of your deal through due diligence

- Help you prepare written documents, such as your business plan, pitch and term sheet

However, even if you do hire an advisor, don’t rely on them to do all the heavy lifting. It’s important that you understand the fundamentals of fundraising and develop the skills to prepare for your pitch and appear confident in your pitch and ongoing negotiations.

Staying involved in the process also shows that you’re committed to your business’s success, something investors want to see in a founder.

5. Choose an investor in your niche

Many investors offer funding to industry-specific businesses. If your business type aligns with one of those industries, seek investment there first.

These investors will most likely have invaluable industry knowledge that you won’t find elsewhere, and their guidance can prove invaluable. Many investors also prefer to fund businesses that align with their target market.

For example, at Tide, we sought funding from VCs that invest in early-stage tech opportunities because we craved industry guidance. In fact, Eileen Burbidge of VC Passion Capital helped us acquire £14 million in our Series A round and acted as our chairperson in a critical period of growth. Her guidance was invaluable as we scaled our business.

That’s not to say it isn’t worth seeking investment in other places. But start with niche investors first, if applicable.

When niches don’t matter

Many investment firms prefer to diversify their portfolio and therefore don’t specialise in one market over the other. Instead, they care more about your business model and whether it’s profitable, repeatable, expandable, predictable and defensible.

Plus, they want to see that you and your team have the passion, tenacity, flexibility, coachability and teamwork necessary to get the job done. If you have a big idea and a solid team to back it up, you may not need to seek the type of specific guidance you’ll find in a niche investor.

6. Create a winning pitch deck

Now that you’ve completed your research and have an idea of whom you want to pitch, it’s time to create a pitch deck that will earn you an investment.

The most important thing to remember is that you should tell a story throughout your presentation. Stories help the listeners place themselves in your target audience’s shoes. They also help to engage and captivate your audience as you introduce your vision and ultimately explain why your business deserves funding and guidance.

With storytelling in mind, let’s dive into a slide-by-slide look at what a good pitch deck should include.

Slide 1: Vision and value proposition

Start with a quick one-sentence overview of your business and the value you provide to your customers. Keep it short—140 characters or fewer. It should be attention-grabbing and easy to understand.

Many businesses compare themselves to other well-known companies to make their value proposition crystal clear. For example, “We’re the TripAdvisor for volunteer opportunities”, or “We’re the Uber Eats for prescription medication”.

Airbnb used to be called AirBed&Breakfast and in their seed funding pitch deck their value proposition was, “Book rooms with locals, rather than hotels”.

Slide 2: The problem

Explain the problem you’re trying to solve and exactly who has this problem. Make it relatable so that investors can easily understand and even identify with the problem you are trying to solve.

Outline how you know it’s a problem and introduce light research to back up your statement. If applicable, tell a short story of how you discovered the problem and why it interests you.

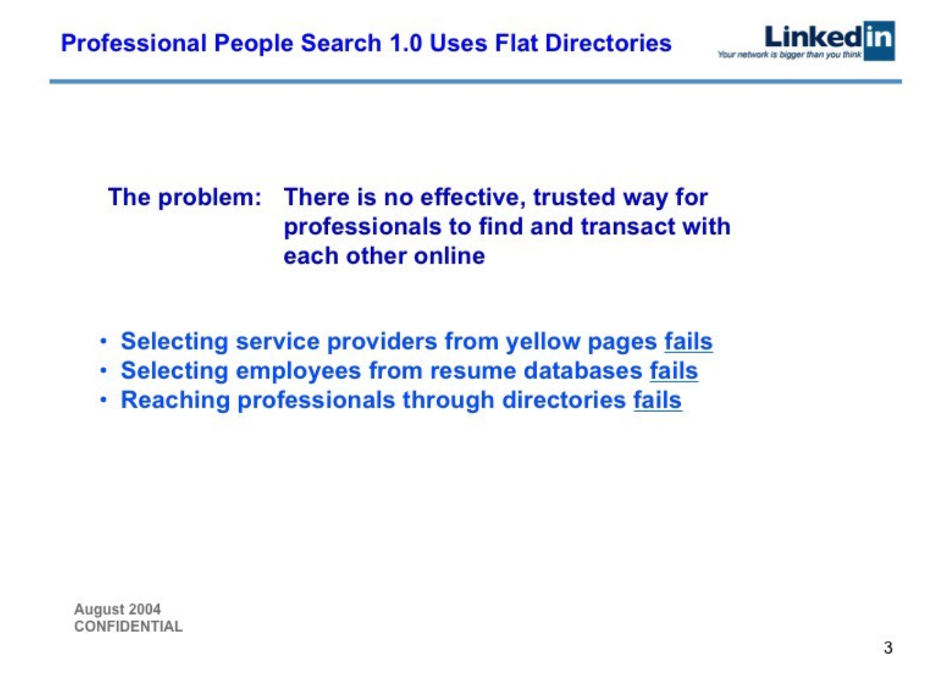

For instance, in their Series B round, LinkedIn outlined the problem by showing how the existing solutions fail to solve it.

Here, LinkedIn approached potential objections by addressing them head-on. Because they had already validated their idea by obtaining investment in Series A, they didn’t need to prove the problem existed. Rather, they needed to prove that their solution, if given the chance to grow, would overtake every other solution that’s still on the market (and it did).

Slide 3: Target market and opportunity

Go into more detail about who your target audience is and the market size. Explain how you will position your business within this market and how you’ll stand out from competitors.

This helps to explain the scope of the problem you’re trying to solve. Be specific with numbers and use your market research here.

If you have several market segments of varying customer persona profiles, share that information as well. It will show that you’re aware of the nuances within your target market and realise that people experience the problem in different ways and for different reasons.

Slide 4: The solution

Describe your product or service and how customers will use it. Think of this slide as the hero of the story.

You’ve built up a problem that resonates with the investors and now you’re showing how your product or service solves this pain point. Use visuals, such as pictures or video, to help bring this idea to life.

Make sure to touch on some alternative existing solutions and why your solution is better. What makes you unique? Focus on both features and benefits, and make sure to include several finished-story benefits.

For example, a feature is “seamless financial integration”. A benefit is “real-time automated sync”. And a finished-story benefit is “free-up your valuable time so you can focus on what matters.”

Investors are bombarded with features and benefits day in and out, but the finished-story benefit paints a picture. It’s the “why” behind the “what” of your business.

Don’t go too far into competitive analysis here though. Focus more on what makes you unique and save the big overview of competitors for a slide later on.

Slide 5: Validation roadmap

This is one of the most important slides in your pitch. If you have early adopters or sales, talk about that here. This will show you’ve proven your business model, validated your idea and are amassing a customer base.

Nothing is more captivating than a proven business model, especially for Series A investors. The more you can convince VCs that your business model is worth their time and money and doesn’t pose a huge risk, the better chance you have of keeping their attention for the rest of the pitch.

Mention the milestones you’ve already achieved and the upcoming milestones you plan to achieve with this capital.

To create a good roadmap, answer the following questions, if applicable:

- How many paying customers do you already have?

- How much monthly and annual revenue are you generating?

- What’s your growth rate?

- Are you profitable? If not, when will you be?

- Do you have key partnerships in place?

- Do you have any key testimonials?

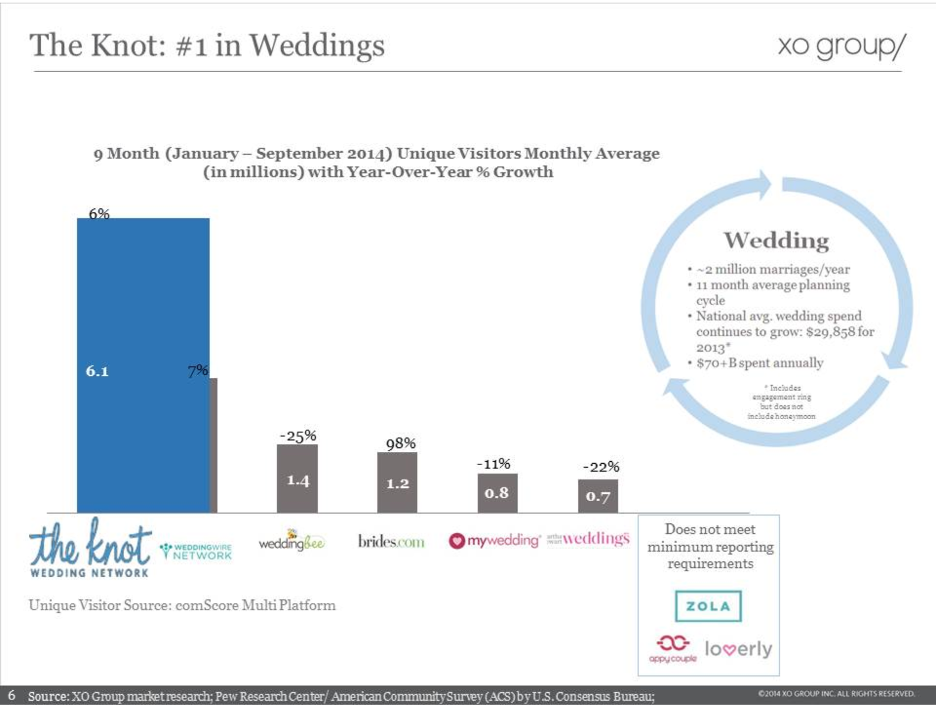

Wedding business The Knot does this well in their Series C pitch deck.

They clearly demonstrate that their business model is pulling in significantly more unique visitors month-over-month than their competitors. The graph is visually compelling. Using the colour blue, compared to competitors in grey, and the thicker bar makes their stats pop.

Slide 6: Revenue model

Now that your audience is hooked, explain how your product or service will make money. If you’re seeking seed investment, use this slide to prove that your idea will quickly become validated and profitable with the capital you’re seeking.

Outline how competitors make money and how you’ll get your income. Are you offering a monthly subscription service or one-time payments? Do you make money from customers or advertisers? Will you be offering free trials? If so, what’s the conversion rate from free to paid users?

Describe how your pricing structure compares to other key players (i.e. higher, lower, similar). Explain why you chose your pricing structure and the methodology behind it.

Top Tip: Choosing the right pricing structure is a key part of your business planning. Will you price higher, lower or similar to your competitors? What does the market demand? Learn how to answer these questions and more in our guide on how to price your product 💷

Outline your projected revenue, how much it costs to acquire a customer, or your customer lifetime value (LTV). However, don’t go into financial forecasts just yet—that’s coming in a later slide. The key for this slide is revenue and acquisition costs, two key factors that investors often care more about at the outset.

Slide 7: Marketing and sales strategy

How are you planning to attract new customers? What have you done so far that’s worked or failed? How did that help you pivot to a new, more efficient operation? What’s your sales plan and process? Is this strategy similar or different to what your competitors are doing?

A comprehensive go-to-market strategy proves that you’ve put in the time and effort to know exactly how to attract customers to your value proposition.

A great idea rarely succeeds without a clearly defined marketing strategy, so explain your plan in detail here. This includes the channels you’ll focus on, given your current resources, as well as your competitive distribution and promotion strategy.

Top Tip: Learn how to create a market strategy that ensures you’re launching the right product or service in the right market at the right time with our guide to building an effective go-to-market strategy 👀

Alternatively, if you’ve already launched and are in late-stage funding, explain how you’ll further penetrate the market based on industry data and identified opportunity gaps.

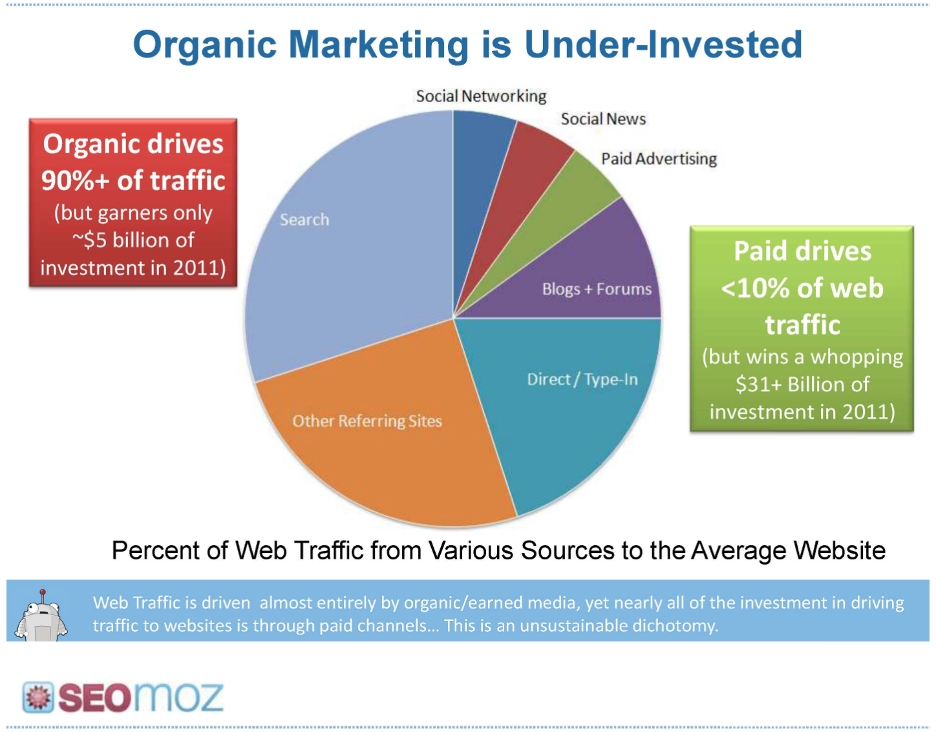

Analytics software company Moz did this incredibly well for their Series B round.

They clearly show how organic marketing drives 90% of traffic but wins significantly less investment than paid marketing. This doesn’t make any sense, and they are almost tempting the investors to break the mould and invest based on a missed opportunity.

Slide 8: Your team

Why is your team the right team to get the job done? Investors want to know that you have the best team to execute this idea—after all, they’re investing in you and your idea, and a great idea is weak without a great team behind it.

Highlight the key players and what expertise they bring to the table. What are their relevant skills and experiences? Where and how did you meet and what projects have you successfully worked on together?

If applicable, introduce your advisor(s) and explain how their experience is relevant to the problem you’re trying to solve.

Slide 9: Financials

Here you can go into more detail about your financials. Borrow from your business plan, but don’t include in-depth spreadsheets. The visuals should be easy to read and understand.

Include your sales forecast and cash flow forecast for at least three years, balance sheet and so on. Mention your revenue-to-date numbers again, if applicable, to remind them that you are already making sales.

This slide is all about explaining your growth based on the success you’ve already achieved or the success of a comparable competitor. Investors want to understand that your projections are based on data and facts and not unreachable hopes and dreams.

Where the revenue model slide hooks the investors, the financials slide reassures them by proving long-term success and growth potential.

Quick Tip: If you don’t have any revenue yet, simply focus only on your financial projections.

Top Tip: Financial forecasting is essential to showing investors your company’s potential. Learn everything you need to know in our guide on how to create a cash flow forecast 🔎

Slide 10: Competitors

Now is your chance to go into more detail about your competitors.

This slide is specific to how you will defend yourself against your competitors. What are your key advantages and what edge you have over your competition?. Essentially, why are customers going to choose you instead of anybody else?

Incorporate competitive analysis visuals into your pitch here. Identify the characteristics of your competitors and go into detail about your established advantages. For example, is your system compatible with more hardware or software solutions than what’s available today? Is your software open source or proprietary?

Show the investors how you can obtain key segments of the market faster than competitors, and how you plan to persuade their existing customers to take advantage of your product or service instead.

Top Tip: Knowing how to differentiate your brand from others in your market can help you stand out and give you a competitive advantage. Learn what you need to get there with our guide on how to run a competitive analysis 📂

Slide 11: Use of funds

Now is the time to ask for an investment and outline exactly how you plan to use the funds. At this point, investors should completely understand what problem you’re trying to solve, how your solution works and why it’s better than anything else.

This is what you’ve been building up to. But, you can’t just ask and end your pitch. You need to ask and then go into detail about exactly how you’ll use this investment to achieve your goals.

Specifically, why do you need the amount of money you’re asking for and where are you going to invest it in your business. Will you use it to build out your team? Or is R&D or product development the next step in your growth plan? If you’re seeking late-stage funding, perhaps you need an infusion for a marketing push to help you reach new markets.

For example, “We are asking for £600,000 at £3,000,000 pre-money valuation to fund our customer acquisition strategies and go-to-market strategy. This will give us 12-18 months of runway to repeat and scale our business model.”

From there, give details on how you’ll divvy up the £600k into specific strategies, such as research, SaaS tools, email marketing and so on.

If you already have other investors on board, mention them here and explain why they chose to invest. This adds social proof and helps further validate your idea.

Bonus tips to make your pitch deck shine

Here are some extra words of wisdom to help you build a top-notch pitch deck.

- Include demos and screenshots throughout your pitch deck to help investors visualise your product or service.

- Keep your deck short and succinct. Don’t overload investors with information or endless bullet points. Rather, build excitement and get them eager to invest.

- Keep your deck current. If you created it a year ago, update it with the latest numbers and progress.

Additionally, make sure to bring a more detailed write-up of your pitch deck (can be your business plan) that you can distribute after the pitch. This should include:

- Elevator pitch or executive summary. The goal of the executive summary is to get investors curious and interested to learn more. Your first paragraph or opening statement needs to have a ‘wow’ factor. Think of the opening line in a Dragons’ Den pitch and include your vision and value proposition.

- Introduction letter. This gets a bit more detailed into your ‘ask’, how much you’re trying to raise and what you’re raising it for.

- Detailed financial spreadsheets. These are the spreadsheets and graphs that were too dense for the pitch, but important for investors to study afterwards.

💡 Expert insights

Jonny Seaman is an Account Manager and Investment Expert at SeedLegals, the one-stop platform for startup legals, and has worked with hundreds of startups on their rounds, from first raises all the way to Series A+. With over 200 closed rounds under his belt, he’s seen the good, the bad and the ugly of startup raising. Prior to SeedLegals, Jonny was a founder himself and also ran the Glasgow chapter of Startup Grind, helping entrepreneurs find the support networks they need to grow their businesses.

What valuation do I give my startup?

It’s no secret that valuing your early stage startup is more of an art than a science, at least at the pre-revenue stage. At this point, your valuation will be built on the size of the potential market, the credentials of your team and, of course, an element of storytelling. Once you are making money, there are a multitude of metrics you can use to settle on the right number, the key ones being ARR (annual recurring revenue), MoM Growth (month on month growth) and gross margin.

From experience, 2022 UK valuations broadly fall into brackets based on the stage the company is in:

Pre-seed stage: You have conceptualised the idea and approached the target market to get some initial interest and traction. The next step is keeping the lights on while building out a minimum viable product:

- Raising: £100k – £350k (from friends and family and early angel investors)

- Valuation: £750k – £1.4M

Seed stage: You have now used pre-seed funds and/or bootstrapped with your own time and money. At this point you’ve built 80-100% of the initial offering and can now show solid traction through a growing waiting list or potentially are already generating revenue of around £5k – £30k a month.

- Raising: £500k-£1.2M (from angels and early VCs or funds)

- Valuation £2.5M – £6M

Series A: At this point, you are reasonably confident on product-market fit, have been revenue-generating for a while and are reaching or have achieved £1M ARR (£85k+ per month).

- Raising: £3M – £10M (VC-led, with a few angels following on)

- Valuation: £12M – £40M

It’s worth noting that there’s no one-size-fits-all approach to valuing your startup and it varies by industry and geography – in Silicon Valley, you could quadruple the numbers above. But based on our data, these are the rough valuation brackets for the startups we support.

When’s the best time to raise?

At SeedLegals we’ve worked with over 35,000 startups and investors and seen over £1bn raised through our platform. From the data we have from all these deals, we’ve observed three spikes of fundraising activity every year:

End of the tax year

The weeks leading up to 5 April are busy, particularly for SEIS and EIS rounds (a tax-relief scheme available to UK investors). Investors are keen to get deals closed before this deadline to make sure they get the maximum tax relief in the current tax year.

Just before the summer holidays

Traditionally, many investors take time off in July and August. If your deal isn’t done by the end of June, it probably won’t be closed until September or later. This means there’s a scramble for founders and investors to complete their deals before July. We have compiled some useful tips from our experts on how to close before the holiday season, should you find yourself raising capital in the summer.

Run-up to Christmas

Similar to the summer holiday shutdown, this spike in activity shows how keen founders and investors are to get all the paperwork done and deals closed before taking a break for the festive weeks.

I’ve received a term sheet. What comes next?

First, pat yourself on the back – it’s important to celebrate the wins as they come. Next, it’s time to get to work on moving that highlighted yellow number from the term sheet to the company accounts.

In reality, the term sheet is the beginning of the negotiation. This document outlines the investment amount, proposed valuation, board structure, the particulars that need investor consent and a multitude of other terms. All of these and more are points of negotiation in the round so it’s important to only sign up to terms that you are comfortable with.

Once you and your investor are satisfied with the terms, it’s time to bring in a trusted advisor or legal partner to assist with the review and drafting of the longform documents (Shareholders Agreement, Articles of Association and Resolutions) to turn this offer into a completed investment. Our data shows that on average, funding rounds take 55 days from open to close, meaning it’s important to come in prepared and manage cash flow accordingly as you progress through the raise.

📹 Masterclass video: How to approach investors to fund your business

What’s the best way to approach investors? We might think we know what happens at an investment pitch, having watched Dragon’s Den, but how do we get to pitch in the first place? And what do investors want to know?

In this Masterclass, we’ll help you understand what potential investors want from you and what you need to do to get that “yes”.

Our Events Manager Cuan Hawker is joined by Tide’s Founder, George Bevis, who is also the Founder and CEO of CanDo, a social ventures incubator.

During lockdown, George and CanDo launched Pop to the Shop, a service to connect local volunteer shoppers to people in self-isolation who need help.

In this Masterclass, you’ll learn:

- How to pick the right investor. Matching your business to appropriate investors makes it more likely your pitch will succeed.

- How to write your first message. Tips for a successful first approach.

- How to create your pitch. What to say or write to get a ‘yes’.

- How to present your pitch. Expert advice on what to do and not do.

- How to get to know the numbers. What you need to learn about your business’s finances.

Wrapping up

Raising venture capital is as exhilarating as it is exhausting. It requires a ton of time and effort and a commitment to seeking not only capital but industry guidance.

Seed and venture capital can be just what you need to launch your business into the market and achieve your goals and dreams. Take the time to prepare, network, seek advice and craft the perfect pitch to give yourself the best shot at success.

Ready to be your own boss? Register your business with Tide for only £9.99

Registering your business with Tide is incredibly fast, easy and £9.99 instead of £50. You not only get to officially start your company, but you get a free business bank account at the same time, which is the best way to ensure you’re keeping your finances in order from day one. Be your own boss and register your company with Tide 🚀

Photo by Gustavo Fring, published on Pexels