How to conduct market research for your business idea

If you don’t know who you’re selling to, you may miss important acquisition opportunities. Market research helps you to uncover key information about your target market so that you can reach, engage and ultimately convert your ideal customers into buyers.

The internet has made it easy for customers to find out information about brands online. The same is true for small business owners looking to figure out how to do market research for a business idea.

Market research will help you to discover who your ideal customers are, where they hang out online or in-person and how and why they make purchasing decisions. Armed with this information, you can get in front of your ideal audience in the right place at the right time, thus grabbing their attention and motivating buying behaviour.

In this article, we’ll explain what market research is and why it’s important, outline several types of market research and detail how to do your own market research to boost reach, drive conversions and increase revenue.

Top Tip: Conducting market research is a key part of ensuring that your start-up idea is something that people actually want and/or need. Once you’ve finished your research, you’ll need to get into the nitty gritty of creating a brand for your business, choosing your company formation structure, educating yourself on business laws and regulation, sourcing funding (if necessary), and marketing your business. You can learn how to do all of this and more in our guide to 10 effective steps to start your business in the UK 📌.

Table of contents:

- What is market research?

- Why is market research valuable?

- Types of market research

- How to conduct market research in 5 steps

- 5 common market research questions

- Wrapping up

What is market research?

Market research is the process of identifying information about your target industry as well as your target customers.

When starting a new business, it will help you to answer the following questions:

- Demand: Is there a desire or need for your product or service? If so, what problem or pain points does your offering solve and how can you better align it to suit this demand?

- Market saturation: How many similar options are already available to consumers? Further, what are those businesses who are already in the space doing well and where are they missing opportunities? What can you do differently to fill in these gaps?

- Market size: How many people would be interested in your value proposition? This will help you to forecast your startup budget or, for businesses that are post-launch, this new product or service budget. From there, you can also predict revenue and profitability.

- Economic indicators: What’s the income range and employment rate of your target audience? This is the first step in customer research and it will help you to create detailed customer personas (more on these later on).

- Location: Where do your customers live and hang out, both geographically and online, and where and how can your business reach them?

- Pricing: What do potential customers pay to your competitors? This will help you to figure out exactly how to price your products or services so that you can stay competitive and achieve profitable markups.

The results from this research will help you tailor your marketing efforts and brand messaging to better engage your audience. And, it will help you to design and package your product or services in a way that aligns with your audience’s needs. All of this leads to better conversion rates, sales and revenue.

Why is market research valuable?

Understanding your customers is the most effective way to drive engagement and increase loyalty. Knowing their desires, needs and pain points helps you create a better user experience and cater to audience demand.

Market research is invaluable because it gives you compelling insights into user behaviour. While data and analytics give you a high-level overview of behaviours, market research goes a step deeper and uncovers what drives user intent. If you can unearth user intent, you can speak directly to your consumer with personalised messaging that motivates them to take action.

Market research also helps you uncover industry trends, ensuring you’re staying in line with what customers want and need out of similar products or services within the same industry.

Competitor research like this helps you figure out what your competitors are doing well and where there are gaps in their strategy that you can fill. Plus, getting a sense of small business trends in your target market will help you to understand how they will impact your revenue and profits.

Types of market research

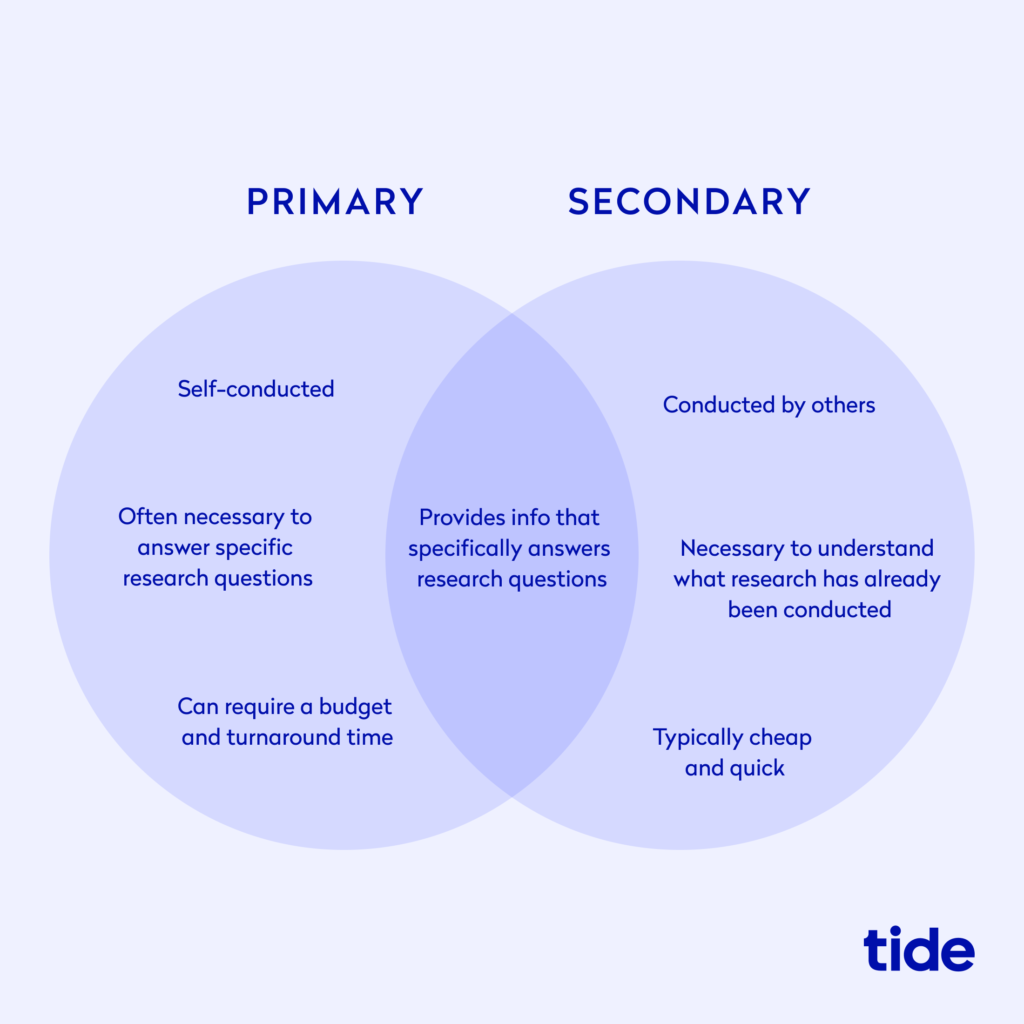

There are two main types of market research methods: primary and secondary. Primary research entails speaking directly to the source, or direct-to-consumer, and secondary research is the act of gathering data from existing third-party sources.

Both main types of research utilise qualitative and quantitative research methodologies.

Qualitative research focuses on data from first-hand observations, such as interviews, focus groups and questionnaires.

Quantitative market research, on the other hand, focuses on collecting and analysing big data from larger sample sizes, such as demographics, spending behaviour and opt-in rates.

| Qualitative research | Quantitative research |

| Words | Numbers |

| Identify | Measure |

| Explore | Analyse |

| Understand | Validate |

To conduct the most well-rounded market research, you should incorporate both types of research and methodologies. It’s easier to start with secondary research and move into primary research once you have an idea of general industry and consumer trends. As secondary research has already been compiled and published by others, it’s less time-consuming and often cheaper than primary research.

If you’re starting a new business, whether a full-time endeavour or a side business for extra income, this market research will be critical when creating a market analysis section in your business plan. Showcasing exactly what your competitors are doing, how your business will fill industry voids and your plan to attract your target audience will help to generate interest in your business idea.

Let’s dive into the two types of market research in more detail.

Secondary Research

Secondary research is third-party data that gives you a high-level overview of your target market. This data can be found in trend reports, market statistics, industry content, your own sales data if your business is post-launch, studies by government agencies, trade associates or other businesses.

There are two main ways to access secondary research data.

- Public Sources: These include government statistics, academic databases, news sources, published books, published studies, and so on. Publicly sourced information is often free and you can find it online or in libraries. Such sources in the UK include the Office for National Statistics, the British Chambers of Commerce and the Federation of Small Businesses and more.

- Commercial Sources: These sources are often in the form of statistics from private-groups that you have to pay money to gain access to. Such companies include Forrester, Gartner, International Data Corporation (IDC), Everest Group, Mintel, Euromonitor, YouGov and more. You can also use online sources (both free and paid) that analyse online behaviour and trends like Google Trends, Product Hunt, Social Mention and SimilarWeb.

Primary Research

Primary research is research you conduct yourself in order to gather more detailed information about your specific target audience. You should begin primary research only after you’ve completed secondary research as it’s meant to fill any missed gaps from third-party sources.

There are three main ways to do primary research.

- Exploratory research: This involves talking directly with people. You should have an initial sense of your target audience from your secondary research, so this is the first time you’ll be communicating directly with them. Start with broad, open-ended interviews in an attempt to narrow down this group into a more niche audience.

- Specific Research: Once you’ve generated this smaller, more niche group, use the same methods that you applied to your exploratory research. But this time, ask more specific questions to get more valuable and intent-driven answers.

- Internal Sources: If you’ve already launched your business and are conducting market research to see if the industry has changed since launch, collaborate in-house to see what your existing customers are saying. What were their challenges and pain points at launch and how have they changed? What are your customer’s biggest needs now? What do they say you can be doing better? The idea is to learn from and improve upon your original research by combining historical with updated customer-driven insights.

How to conduct market research

There’s no one specific way to do market research. Generally, you want to start broad and narrow your research as you learn more.

Once complete, you should be able to define your buyer persona, know their specific needs and pain points, understand how your competitors are positioning themselves in the market and identify your opportunity to gain a competitive advantage.

Here are five steps you can follow to organise and optimise your market research process.

1. Define your buyer persona

The key to driving brand engagement and purchasing behaviour is the ability to connect with your target audience. Otherwise, you’ll be promoting your product or service to a wide array of potentially uninterested parties, wasting valuable time and money.

Defining your target audience is the first step of your primary research efforts. Once you understand who you are selling to and what their interests are, you can and subsequently reach out directly via your secondary research initiative (we will explain how to do this in step 2 below).

From there, you can begin to create a buyer persona. Use your target audience research to create buyer personas that answer the following questions:

- Who are your customers and why are they interested in buying your product or service?

- What characteristics, interests, desires, pain points and needs do they share?

- Where do they live?

- How old are they?

- What is their education level?

- What is their income range?

- Which types of websites do they frequently visit?

- Where do they currently buy similar products?

- Which languages do they speak?

- What industry do they work in?

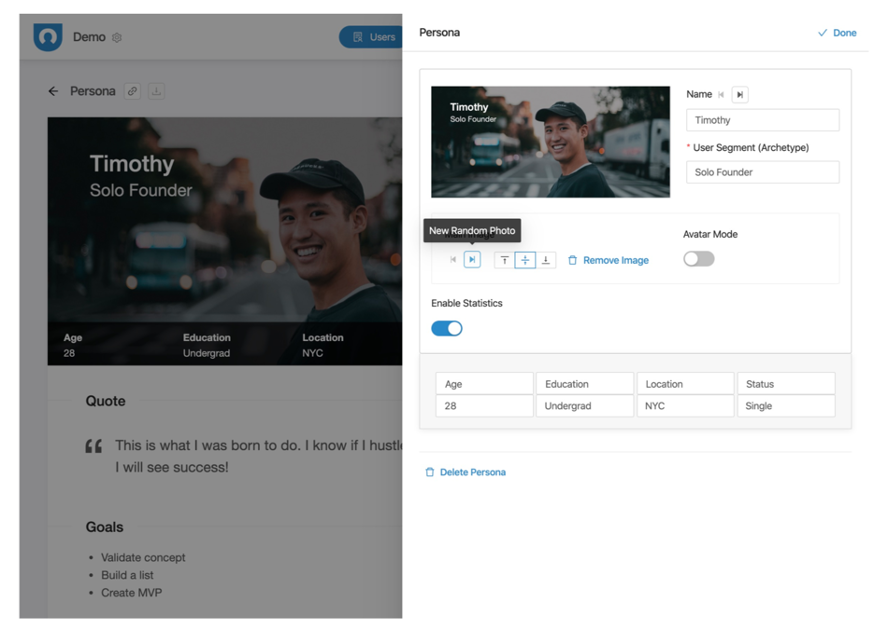

Use the aforementioned public and commercial resources to gather and compile this data. Once complete, you can build your customer persona. This step is important because you can distribute a detailed, shareable document amongst your team or potential investors to guarantee everybody clearly understands your target audience.

You can use online tools like HubSpot’s customer persona creator, Xtensio, Userforge or Smaply to build basic buyer personas quickly.

Top Tip: This is the first step in building a marketing strategy that will help you gain traction and boost brand awareness. To learn more about how to attract your ideal audience, read our guide on how to build a go-to-market strategy.

2. Engage with a small target sample

Now that you’ve completed your initial customer personas and market research, it’s time to dive deeper into your audience’s behaviours. This is where your secondary research efforts come into play.

You can reach out to your target audience in several ways across many mediums. Remember to begin with exploratory research by asking open-ended questions and follow up with specific research that unveils invaluable insights.

- Surveys: Use online surveys to ask a group of people a set of questions. Often, an online survey is delivered via email, but it can also be posted on social media platforms or online forums. Surveys are easy and cheap to conduct, the results come in quickly and the data is straightforward to analyse. You can use platforms like Survey Monkey, JotForm, Google Forms, LimeSurvey and more.

- Emails: Send a cold email asking if they will be open to answering some of your questions. You can attach your survey to this email and/or use it as a platform to schedule a more in-depth phone interview.

- Phone calls: Phone interviews allow you to speak directly with your potential customers. Use their answers to formulate your follow up questions to dive deeper into intent and expose insightful trends.

- Face-to-face: This will be exactly the same as the phone interview, but one-on-one in person. In-person or interviews via video conferencing can be more valuable than phone calls as they give you the opportunity to see body language. Sometimes, you can learn more about what a person is feeling based on their body language rather than their words. Observation is key in face-to-face meetings.

- Focus groups: Focus groups bring together a group of selected participants to answer questions in real-time. Usually, a trained moderator will lead the discussion and ask questions about your product or service, user experience, user expectations, competitor products or services, marketing and branding messaging and more.

- Call for participants via social media: Post on social media platforms to generate interest about participating in any of the above methods. Make sure you are posting your questions in the places that your target audience hangs out online, such as LinkedIn, Facebook groups, Twitter, Reddit, and so on, so that you attract people that align with your unique customer personas.

- Leverage your network to get participants: Apply the same methodology as your social media call for participants when leveraging your own network. Reach out to friends, former coworkers, family members and more to see who among them fits into your customer persona and is willing to participate.

3. Identify competitors

Gathering information about your competitors helps you figure out who their audience is, how they communicate with them and how they position themselves in the marketplace. This will help you to learn from their successes and failures so that you can replicate the fruitful tactics and avoid messaging or branding that received negative feedback.

There are two types of competitors to identify.

- Industry competitors: Industry competitors are those that saturate your target marketplace. For example, if you are selling a SaaS video conferencing tool, your competitors will be businesses like Zoom or GoToMeeting.

- Content competitors: Content competitors may not be competing in terms of the products or services they sell, but they are competing in terms of content creation. For example, if you run a leadership training business, a content competitor will be a business that creates content about how to be a great leader. This content competitor could run a finance business, a retreat business, a SaaS business or so on, but because they create content that targets similar keywords, they are a competitor in that specific space.

It’s important to understand as much as you can about your competitors so that you can make better decisions. Learn everything about your competitor’s audience and apply those insights to your branding and marketing strategy.

4. Analyse data

You will amass a ton of information throughout this process. Make sure that you are using a system that helps you organise it so that it doesn’t become overwhelming.

Here are some ideas on how to do this:

- Sort your data into groups to better understand the big picture

- Create several distinct customer personas if you learn that you have more than one audience type

- Build a matrix chart to see how often pain points, desires, needs and attributes overlap

- Generate a customer journey map to outline the journey from awareness to purchase, using free or paid tools like LucidChart, HubSpot or Visual Paradigm.

| Customer Journey: Buyer’s Journey | Awareness Stage | Consideration Stage | Decision Stage |

| What is the customer thinking or feeling? | |||

| What is the customer’s action? | |||

| What or where is the buyer researching? | |||

| How will we move the buyer along his or her journey with us in mind? |

Once organised, you can draw meaningful insights from your data collection. This will help you to further shape your offering and messaging.

5. Summarise findings

Summarise your findings in a simple and shareable format. Draw inspiration from the common themes you discovered to help tell a story about your target audience.

This will guide future marketing and branding efforts and help your team and potential investors develop a clear picture of who your ideal audience is in their minds.

Add in quotes, diagrams, call clips, video clips and more to amplify the audience’s voice. Outline who you talked to, common themes and if you will stay on course or pivot based on any common feedback threads. End the summary with immediate next steps and action items.

It’s only £9.99 to register your new limited company with Tide and we’ll also open a FREE business bank account for you. If you need to, you can opt for a virtual office address to keep your home address private. And as your business grows, you can choose to upgrade to Plus or Premium membership, for enhanced service and perks. Register with Tide – find out more.

5 common market research questions

The most effective questions get to the heart of the matter and help you obtain invaluable insights. These insights will affect who you target, where you position your brand, what your messaging will be, what voice and tone you will use and much more.

Here are some common market research questions.

1. What do you look for in a brand?

This will help you figure out what matters the most, at a high-level. For example, does your audience care about engaging with brands that support a good cause, or do they prioritise quality above all?

From this answer, you’ll have a better idea of what to include in your messaging. If your audience prefers brands that support a good cause, you can forge partnerships with nonprofits or charities and commit to donating a portion of your proceeds to them. Then, add this messaging on your website or in your content to make sure your audience is aware of your stance.

2. What are the reasons or actions that drive you to make a purchase?

Based on that answer, you can ask more specific follow up questions such as:

- Do you prefer testing products with free trials, or are explainer videos sufficient to pique your interest?

- Do you prefer when a company is active on social media or do you not care so much?

- How much does a business’s customer service response influence your brand loyalty?

Use these answers to uncover desires, expectations and experiences that influence your focus in these areas.

3. What problem were you trying to solve or what goal were you trying to achieve when you purchased from [COMPETITOR]?

This answer will help you understand your competitor’s audience to see what their intent was before making a purchase. You can use these insights to position your business as a better solution to their problems.

4. What challenge(s) at work has [COMPETITOR’S] solution failed to solve?

From this answer, you can identify pain points that your competitors have yet to build a solution to. Ideally, you can get to market before them and present your product or services as the solution that will fix their ongoing problem.

5. What does your day look like?

While broad and open-ended, this question will help you learn more about your target audience in general. You need to not only understand what drives their buying behaviour, but who they are in a larger sense.

This will help you build empathy for your audience, which will only serve to help you when speaking directly to them and personalising messaging. Plus, you may uncover something you didn’t previously know about their buying habits from this answer.

Wrapping up

Market research is crucial in order to identify, understand and segment your target audience. Further, it allows you to gain a high-level understanding of your target industry as a whole, giving you the data you need to competitively price your products and forecast revenue.

Without market research, you will be selling blind. The most successful companies not only understand their place in the market and exactly who they are selling to, but how and where to target them.

Plus, they know why their target audience makes certain purchasing decisions, helping them to skew their messaging in a way that captivates, engages and produces results.

Photo by Startup Stock Photos, published on Pexels