What is job costing? A guide to tracking costs for small and construction businesses

In 2020, only 65% of construction businesses turned a profit. This is a marked decline from previous years. As construction businesses and other small and medium enterprises (SMEs) struggle to come back up to speed, how can they get their accounting houses in order and achieve profitability?

Job costing is crucial in helping small businesses achieve profit margin goals. This accounting practice helps companies make better management decisions, boost profits and estimate project costs.

Simply put, maintaining profitability is critical to keeping your small business running and growing. Job costing is a way of making sure you don’t leave profitability up to chance.

In this article, we’ll look at what job costing is and how it helps SMEs maintain financial viability. We’ll also go in-depth on the variables used to calculate it, share methods to help simplify the accounting and give some examples of what job costing looks like.

Contents

- What is job costing?

- Why job costing is critical for maintaining profitability

- How to calculate job costing

- Helpful and simple job costing methods

- Examples of job costing

- Wrapping up

What is job costing?

Job costing is an accounting practice that tracks the costs and revenues of a specific job or individual project. Calculating this helps SMEs understand the ratio that determines their profit.

Job costing is common in construction, where costs may vary greatly from one job to another. But it can be applied in any business that produces a product to customer specifications or where individual client projects are distinct. Some examples of businesses that may use job costing include:

- Construction

- Retail

- Manufacturing companies

- Law firms

- Accounting firms

- Investment companies

While job costing only analyses the profit and loss on an individual project, it is an important part of your overall small business accounting process.

Seeing spending over time lets you see how project expenses affect the overall financial picture and helps you formulate business strategies to control costs in the future. It also keeps financial reporting timely, helping accountants track expenses for tax filing and financial analysis.

Top Tip: You need a good grasp of small business accounting to manage your business well. A strong understanding gives you the tools to run and grow your business effectively. Learn about the basics and how to leverage them in our guide to small business accounting💡

Why job costing is critical for maintaining profitability

Job costing is a big part of keeping track of expenses and has several benefits for your company. Consider these five ways job costing builds and protects your financial wellbeing and shapes your business strategy.

Top Tip: Managing expenses effectively is essential to saving, paying taxes correctly and improving your overall business health. Learn what expenses are, what you can claim and how to claim them in our guide to what expenses are and how small businesses can manage them 💸

1. You see the profitability of each type of project

With construction and many other client-serving SMEs, each project differs in scope and purpose. Job costing tracks the costs for each and the revenue you bring in case by case.

Understanding these figures for individual jobs can help you maximise your efforts as you start to see patterns in project types over time. For example, profit margins will likely be different for building industrial parks vs custom homes or shopping centres.

When you track job costing for each, you’ll know which projects brought in the most revenue and see which types are more profitable after expenses. You can then target your business strategy to focus on the projects that bring big enough margins to build a thriving business.

2. You generate more accurate estimates

Job costing offers you robust financial reports to use as the basis for future project estimates and strategies. When you can see trends in spending broken down by project and resources, you’ll be able to plan for upcoming jobs with more accurate spending and revenue projections.

You can manage projects better when you can compare estimated costs with actual expenses and see discrepancies. This understanding will let you avoid any surprises that might hurt your financial planning. And you’ll have an easier time balancing your books.

Top Tip: Logging expenses helps small businesses manage their spending, resulting in a healthy cash flow and long-term profitability. Learn more with our step-by-step guide to creating expense logs 📓

3. You reduce customer conflict

Avoiding overages and surprises isn’t just good for your bottom line. It’s also good for your customer relationships. When you generate more precise estimates, you can provide customers with more accurate quotes.

When you’ve provided an estimate but then have to keep coming back to communicate adjustments for unforeseen costs, it hurts your reputation. Unexpected costs frustrate your clients just as much as they frustrate you.

When you keep track of job costs, you’ll be able to set and meet expectations with less chance of surprises.

4. You eliminate inefficiencies

You’re much more likely to identify unnecessary costs and wasted resources when you can look back on thorough tracking and analysis.

Careful accounting over time will show you things like repetitive work that could be automated. Or situations where you’re allocating more employee resources than are needed. Seeing the patterns will help you recognise and avoid resource wastage in future planning.

Top Tip: Strong businesses know how to use the money they generate to its best potential. Learn how to boost your earnings by listening to our masterclass on maximising your profits 📈

How to calculate job costing

Job costing digs deep into the underlying costs of specific projects. It considers three key variables—labour, materials and overheads—and combines them to generate an accurate picture of a project’s profitability. Let’s take a look at how each variable is calculated.

Labour

Labour is the cost associated with paying all workers involved in the project. It includes full-time employees as well as subcontractors and any third parties.

There are two types of labour costs—direct and indirect.

- Direct labour refers to workers and hours tied specifically to this project. This includes employees, construction workers and contractors working on site.

- Indirect labour is any work that applies to the overhead pool. It includes positions like managers and supervisors, materials purchasing staff, materials handling staff and quality control.

The labour part of the job costing equation only includes direct costs. To calculate, multiply each worker’s hourly, daily or weekly payroll rate by the amount of time they spend on the project.

For example, if you contract with a speciality contractor at a rate of £200 per day and you estimate they’ll be on the job for eight total days during the project, you calculate that cost as:

£200 (Day rate) x 8 (Number of days) = £1600 (Total cost of labour for this contractor)

For the greatest accuracy, this calculation must be done for each worker or worker group because pay rates and time spent on the project may vary from worker to worker.

Materials

Materials take into account the goods used in the finished product. As with labour, there are direct and indirect costs to consider.

- Direct materials costs can be calculated based on raw materials that go into the project—for example, building materials, like lumber, wiring and steel.

- Indirect materials costs include any materials used that don’t go directly into the finished product and costs associated with the materials that do. They include things like machinery or tools used to complete the construction and materials shipping and storage. It also includes any wastage from unused or damaged materials.

To generate the figure for the materials considered in job costing, add up all the direct material costs only. Your indirect materials cost will be included in your overhead costs.

Overhead

Overhead can be more difficult to calculate accurately as it includes all the indirect costs associated with the project.

Along with indirect labour and materials costs, overhead costs include the percentage of day-to-day business operations associated with the project. That includes things like rent on office space or facilities, utilities, depreciation of equipment used and the expenses of manufacturing facilities.

Because overhead can’t be directly allocated to an individual project, most companies calculate an applied overhead to include in the job costing equation.

- Applied overhead is a fixed rate charged to the project. This rate is often based on historical costs and averaged per project.

- Actual overhead is the carefully calculated actual cost of everything used in the project.

How you calculate overheads will depend on your accounting method. Some companies will estimate overheads at the start of the year and apply this to their project quotations and then measure the actual overhead as costs are accrued throughout the year.

Because overhead costs can be difficult to assess accurately, many companies just include a flat overhead rate for each project—for example, 10% of the total project cost.

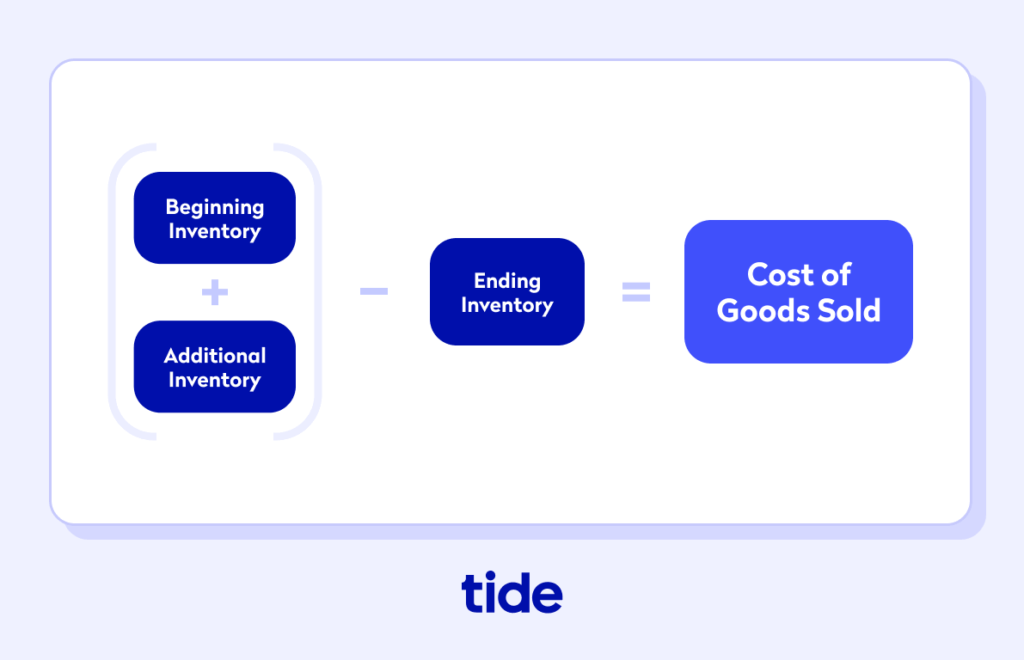

If there is a small difference between applied overhead and actual overhead, it can be directly charged to the cost of sales. Cost of sales, or cost of goods sold (COGS), is the total price a company pays for goods or services produced.

Top Tip: As your company grows, analysing how operations affect revenue and profits becomes vital for business success. Learn how to calculate this metric to benefit your business with our guide: How to calculate cost of sales (with examples provided) 💡.

The formula for job costing

Once you accurately analyse each of the above variables, you can calculate the total job cost by adding them together, as illustrated in the equation below:

The job costing formula:

Direct labour + Direct materials + Applied overhead = Job cost

Helpful and simple job costing methods

Job costing is a critical element of your accounting. But it doesn’t have to be complicated. Here are some best practices and tools to make job costing as accurate as possible without adding complicated administration to the task.

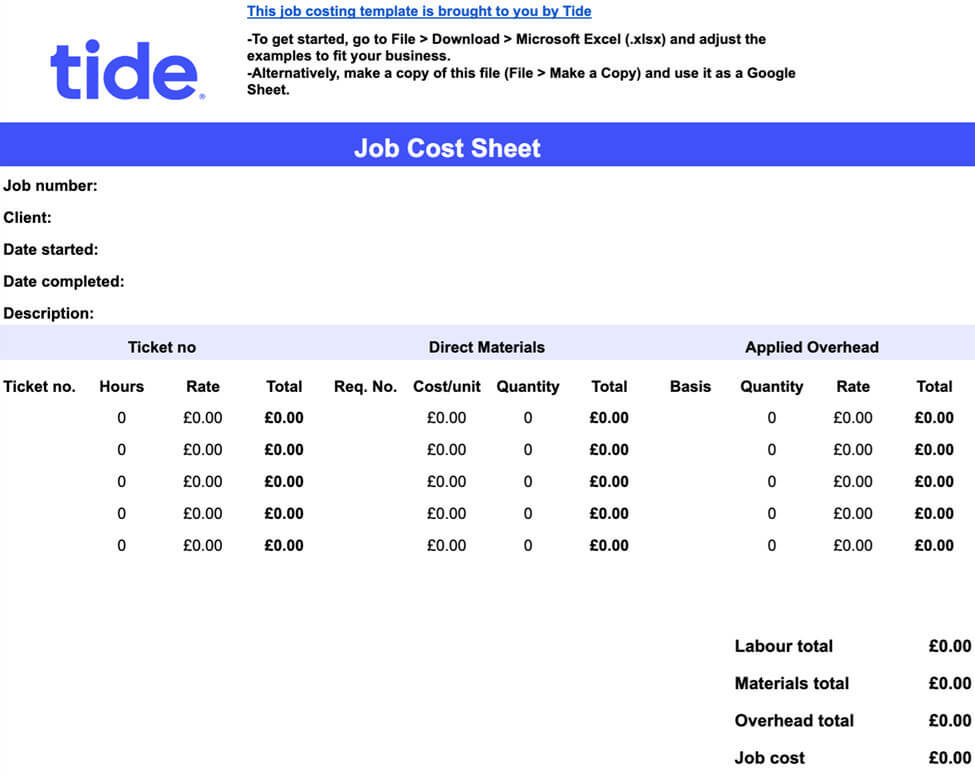

Job cost sheet

Job cost sheets serve as the primary measurement of job costing expenses. Each sheet should record relevant information, including:

- Client name

- Project type or description

- Unique job number

- Date started and date completed

- Direct materials costs

- Direct labour costs

- Applied overhead (including indirect labour and materials costs)

In addition, you may want to track specific order or requisition numbers with materials and timesheet or ticket numbers for labour reports. A job cost sheet template might look something like this:

Accountants track all three elements of job costing in job costing sheets while the project is happening and do a final reckoning once it’s complete. While the project is underway, these costs are often tracked in a work-in-process account. Once it’s finished, final costs are transferred to a finished goods account.

To simplify the complex process of filling out a job cost sheet, you can automate the process with software.

Managing job costing with accounting software

While job costing can be done manually with simple spreadsheets, replicating the process over and over can get tedious and eat up more time than it should.

Accounting software can help manage job costing for even complex projects with a simple user interface. Just enter the numbers and let the program do the heavy lifting.

Accounting software speeds up your time to complete estimates and bids, getting them out quicker. It ensures accuracy of pricing by analysing costs of materials, labour and estimated overhead. Software can also generate real-time reports to keep you and your clients apprised of expenses.

A good accounting program also makes it easier to use the calculations with other accounting functions, such as contributing to expense logs. It should also be able to generate suggested job pricing based on data from previous, similar jobs.

Top Tip: To help you find the best accounting software for your company, we’ve compiled a list of options. Check out tools that address everything from accounting services and bookkeeping to marketing with our guide to the 26 best software and tools for small businesses 🔧

Job costing systems

You can also find job costing systems—software specifically used to track costs and provide estimates. These systems are more specialised for job costing. They can track projects by phases and types, considering relevant information at each stage of the contract.

In addition, a good job costing software will work with your accounting tools to do things like track budgets. Many have apps that let you work from a mobile device.

They also allow subcontractors and vendors to send electronic documents directly to the project. These integrate with your accounting software to help you track budgets and generate pricing on new projects.

Examples of job costing

Fictional construction company ABC Construction (ABC) has been commissioned to build a custom home and is tracking job costing for the work in progress. The accountants track the expenses as follows.

Direct materials. ABC records the cost of raw materials used for the basic construction, including:

- Foundation

- Framing

- Drywall

- Roofing

- Doors and windows

- Siding

- Paint

- Electrical and plumbing

In addition, they take into account finishing touches like appliances, cabinets and heating and cooling systems.

Adding up all the materials in their job costing system gives them an estimated material cost of around £115,000.

Direct labour. The company calculates labour, including the salaries and hourly rates of workers and those of any subcontractors or third parties they’ll also employ. They reach out for time estimates from the contracted architect, electrician and master craftsmen needed to complete the custom work.

Multiplying worker rates by the time each will spend on the job, they reach a figure of £80,000.

Applied overhead. ABC has run the numbers on their annual overhead to determine their markup rate. On each project, they calculate an applied overhead at a rate of 12% of the total project cost.

They add up the materials and labour costs, then multiply the sum by 12% to get the applied overhead cost of £23,400.

Total job costing.

Using the job costing formula, ABC Construction calculates the total:

£115,000 (Direct materials) + £80,000 (Direct labour) + £23,400 (Applied overhead) = £218,400

With this number in hand, ABC can determine how accurate their original bid was and get a sense of how profitable the project will be by comparing it to their total revenue.

If ABC was trying to determine whether or not to take a custom home project over an industrial park project, they could look at the job costing’s of past projects along with their revenue and compare their profit margins.

For example, say ABC had previously completed a similar build for the shell of a single-story, 2,000 m2 warehouse distribution centre. They spent £1,200,000 on direct materials, £115,200 on direct labour and added on their 12% applied overhead cost of £157,824.

The total job costing for this industrial project was £1,471,024.

ABC would then calculate their profit margins between past custom home projects and similar industrial builds to decide which project to take on.

Wrapping up

To ensure your business’s financial success, you need to be aware of costs, revenue and profits.

Job costing is a critical accounting practice for managing expenses and seeing patterns. Knowing how to calculate this number correctly gives you insights that will help shape your business strategy and improve your customer relationships.

You can simplify job costing and general accounting administration by automating them with accounting software. Streamline your financials with a Tide business account that syncs with your software to automatically track transactions. The more efficient your practices, the more quickly and effectively you can boost profitability.

Photo by Tiger Lily, published on Pexels