Stay in control of your business expenses: the Tide Expenses app is here!

Running your own business involves keeping your eyes on many different areas, including sales, turnover, and business purchases, to name but a few. Whether you’re working on your own as a sole trader, or you employ a small team, it can be very easy for business expense management to spiral out of control.

Costs such as fuel, stationery, and travel may all seem relatively insignificant, but if you don’t keep a close rein on your expenses, they can soon start to spiral and begin to erode your profits.

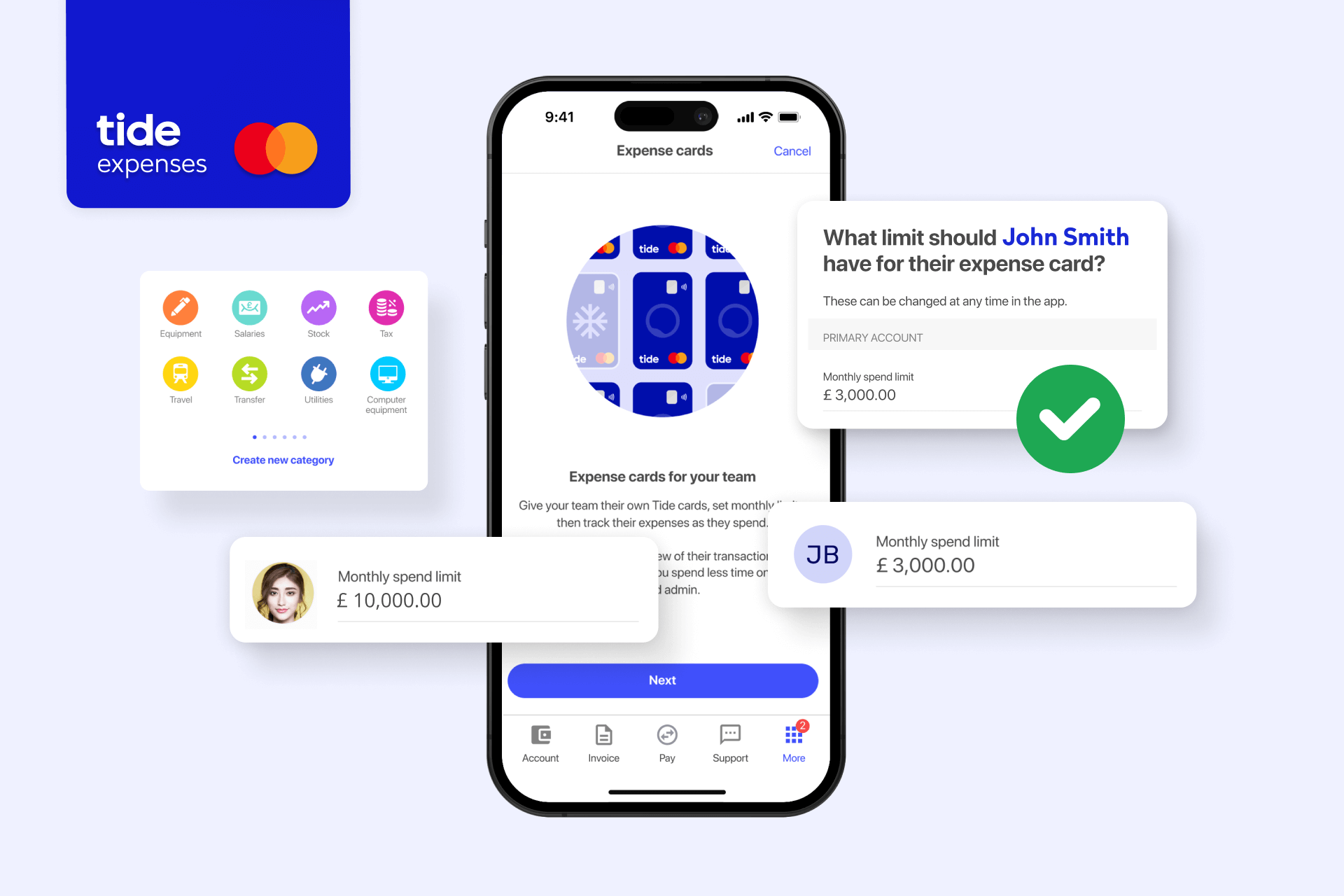

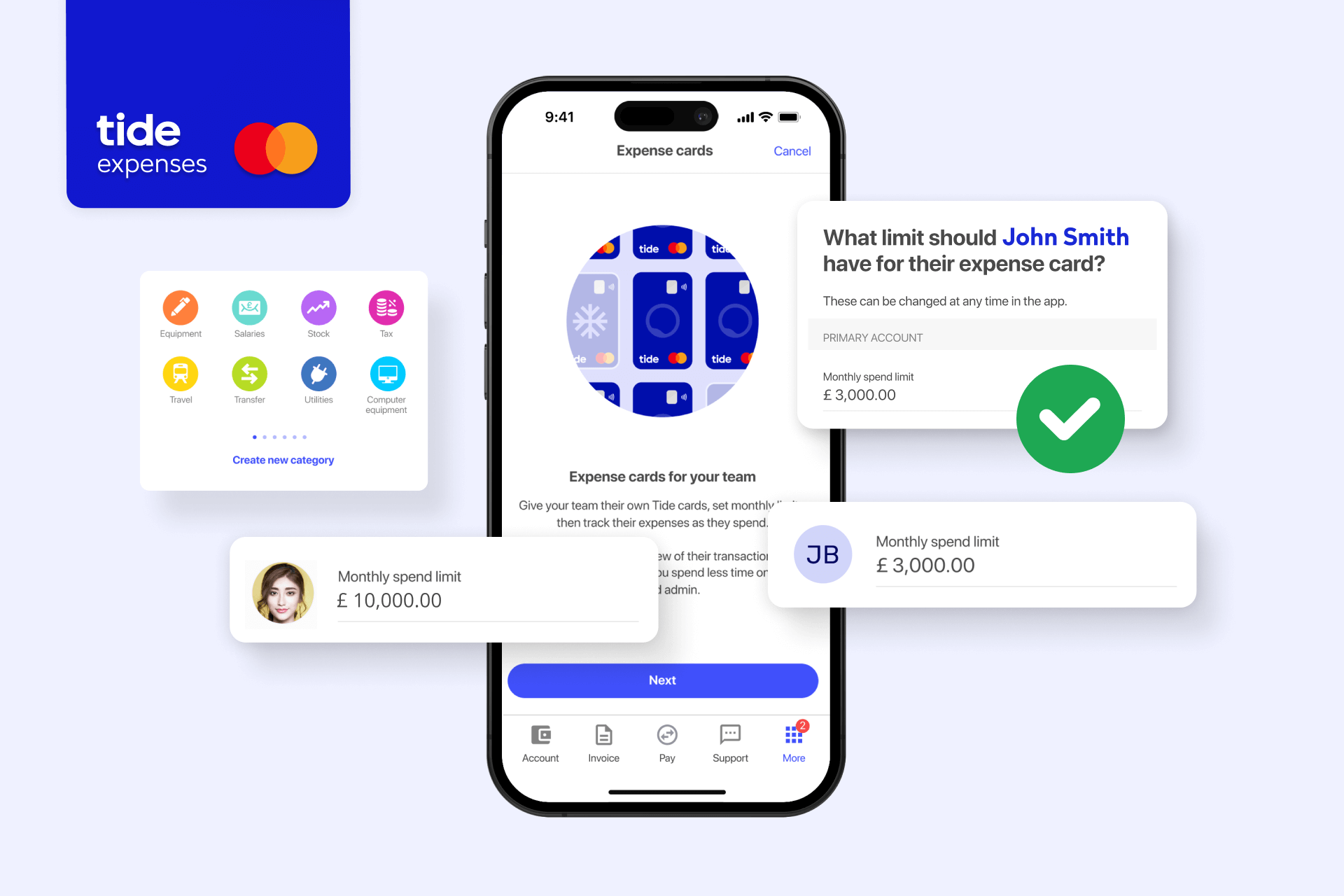

Tide already offers Expense Cards, which, give your team flexibility to buy what they need for their job, and also provide a great way to stay on top of business purchases. However, a brand new Tide innovation is on the way – get ready for the Tide Expenses app!

In this post, we’ll give you the lowdown on how our newest feature works. We’ll also explain how it will, not only help business owners to give teams greater flexibility to streamline how they manage business expenses but will help them take control of costs too.

Table of contents

- A recap of Expense Cards

- What’s new for Tide expense management?

- Saving time and effort with business expenses

- Accounting made simple

- How easy is it to download the app?

- How much does the Tide Expenses app cost?

- Wrapping up

A recap of Expense Cards

Tide Expense Cards are business Mastercards that go hand in hand with our Tide business current accounts. They provide a fast and efficient way to manage business expenses.

As a business owner, not only do they give you peace of mind as you can keep control of your team’s access through the Tide app by freezing and cancelling cards, but you also have the facility to set spending limits too.

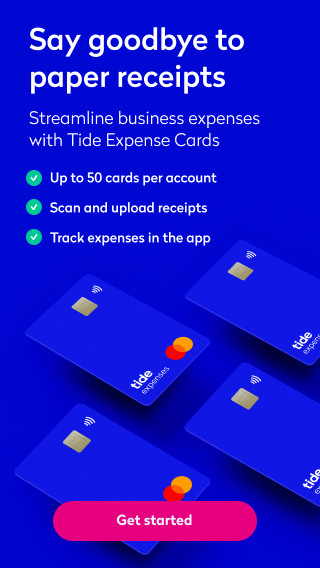

Expense Cards eliminate the need for petty cash, for teams to make purchases out of their own pockets, collect and keep paper receipts or fill in paper expense claim forms. This saves time and means your team can get on with the work needed to grow your business.

For businesses that involve a lot of travel or cover many miles with deliveries, etc, they provide an excellent alternative to fuel cards. They can be used at thousands of petrol retailers across the UK, including supermarkets. This gives team members the opportunity to shop around to take advantage of the most competitive fuel prices.

They are an affordable option too, as they only cost £5 per month + VAT. You can order up to 50 cards for individual team members on your account, making them ideal for small or larger teams. However, if you’ve opted for one of our paid account plans, then you can enjoy one, two or three free expense cards with our Plus, Pro and Cashback account plans respectively.

What’s new for Tide expense management?

At Tide, we’re always striving to develop new and innovative solutions to help those who work for themselves. Our Expense Cards have already helped to revolutionise the way small businesses can manage team expenses.

But, as part of our mission to support small businesses, we’ve now taken this one step further with the launch of the new Tide Expenses mobile app. This is the smart way to save even more time with expense management while empowering your team to spend responsibly and focus on the work that matters.

The new mobile app gives Tide Expense Card holders the freedom to manage cards themselves directly in the app. Previously this would all have had to be done by business owners or directors on behalf of their teams.

Saving time and effort with business expenses

The Expenses app offers several new features designed to take away some of the burdens of finance admin from directors. Team members can now:

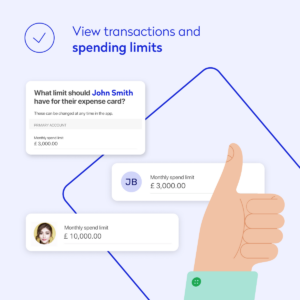

View transactions and expense limits

Keeping track of costs will be even easier with the new Expense App. Expense Card holders, whether they are directors or team members, they’ll all be able to view all transactions as they are made, helping to manage company expenses on the go.

Better still, as well as being able to set individual spending limits for each team member, both cardholders and directors will be able to view this information in the app.

This ensures both teams and business owners know exactly how much is available to spend and when team members are nearing their limit. This is particularly useful for keeping on top of costs, such as business travel, etc.

Business owners will also save time, as spending limits are agreed in advance, eliminating the need for approvals and checks each time a purchase is made.

Team members can upload receipts

Another advantage the new Expenses mobile app brings is that team members now have the flexibility to be able to upload their own receipts, rather than this being something only directors can do.

Being a mobile app, it couldn’t be easier to snap and upload receipts in a few taps when an Expense Card is used for a business purchase.

Team members can also use a helpful notes facility to add information for the account holder/director to provide any extra details on the reason behind the purchase.

The fact that all transactions are transparent and can be viewed by business owners or directors encourages responsible spending, as well as making it much easier to keep track of costs.

With transactions auto-categorised and team members able to upload their own receipts, it also helps business owners spot opportunities for potential cost savings more easily.

Approve e-commerce purchases over £30

Another time-saving feature within the Tide mobile Expense app is the ability for team members to be able to self-approve transactions for purchases greater than £30 in the app.

Previously, directors have had to approve every purchase exceeding this amount on behalf of their team.

You told us you wanted a more flexible approach to be able to approve transactions.

So we listened, and have introduced this function as part of our mission to save small businesses time and money.

Accounting made simple

We understand that the current economic climate is causing tough operating conditions for those who work for themselves. One of the advantages of the Tide Expense app is that it eliminates the need to invest in costly expense management software, as this can all be done quickly and efficiently within the mobile app.

It’s also easier to keep track of costs, as all transactions are automatically categorised as they contain labels that align with the HMRC self-assessment categories. This means, not only can you view and identify at a glance different transactions from your account, but you’ll be getting ahead when it comes to preparing your self-assessment return too. More information on Tide Accounting can be found in our blog entitled Self-assessment made easy.

How easy is it to download the app?

Getting access to the app is very simple.

For existing Tide, members, you can invite your team to download the Expenses app by:

- In your Tide App, go to More, then Expenses

- Select the team member you’d like to invite

- Tap resend login link

For new team members who are going to be using Expense Cards, we will send them a link by email to download the Expenses app.

How much does the Tide Expenses app cost?

After reading about all the time-saving features the new Tide Expense app can offer small businesses, you may be wondering how much all this will cost. The great news is that the app is available for free to all Tide members who hold Expense Cards. If you’re an existing Tide member, you can order Expense Cards for your team directly from the Tide app at a cost of only £5 + VAT per card.

If you haven’t yet joined over 450,000 fellow entrepreneurs and small business owners who are part of the Tide community, then you can sign up for a free business current account in minutes and start to revolutionise how you manage your team’s expenses.

Wrapping up

The new Tide Expense app, together with Expense Cards are just one of the many smart features designed to help the self-employed to streamline their finance admin. As one of the UK’s leading digital platforms, we offer a range of services designed to help those who’ve taken the leap to work for themselves at every stage of their business journey. From company registration to invoicing, integration with popular accounting software, and accessing business loans, tailored for your business, we offer solutions for start-ups to scaling businesses.

And for more hints and tips on business expenses, why not check out our small business tips blog? This features a range of articles written to help small business owners, including how to manage employee expenses and what expenses can limited companies claim.