Managing cash flow: the complete small business guide (Tide Masterclass)

Managing cash flow – the movement of money coming in and out of your company – is essential to ensure a healthy business and to make the most of opportunities to grow.

It can also sometimes feel like an uphill battle, especially if your business is in its early stages.

In our 5-episode masterclass series, Your step-by-step guide to mastering your cash flow, we hosted Philip King, former Small Business Commissioner and Tide Cash Flow Expert, and asked him to share his top tips on the following topics:

- Episode 1: Why it’s crucial to have your cash flow under control

- Episode 2: The importance of knowing your customer to get paid on time

- Episode 3: Why the right payment terms are key to getting paid quickly

- Episode 4: How to get paid on time with bulletproof invoicing

- Episode 5: How to get overdue invoices paid quickly

We’ve summarised the 4 Ws (and 1 H) you should ask yourself when dealing with your customers, to better manage and maximise your cash flow as a small business owner.

Table of contents:

- WHY is cash flow important?

- WHO am I supplying?

- WHEN will the customer pay me?

- WHERE is the money I’m owed?

- HOW do I make sure my invoices are processed successfully?

- Wrapping up

- Have your say

WHY is cash flow important?

Cash flow is critical because it’s the lifeblood of businesses – and neglecting to manage it, or even running out of it, is usually considered the main reason they fail.

“Turnover is vanity, profit is sanity, but cash is reality. Managing cash flow well can be the difference between success and potential failure; ignore it at your peril.”

Philip King, Tide Cash Flow Expert and former Small Business Commissioner

Philip’s advice is to check your bank balance daily. Without a proper understanding of your cash flow, you might face business difficulties. It could also take its toll on your mental health because worrying about late payments can disrupt your focus and the way you manage your work.

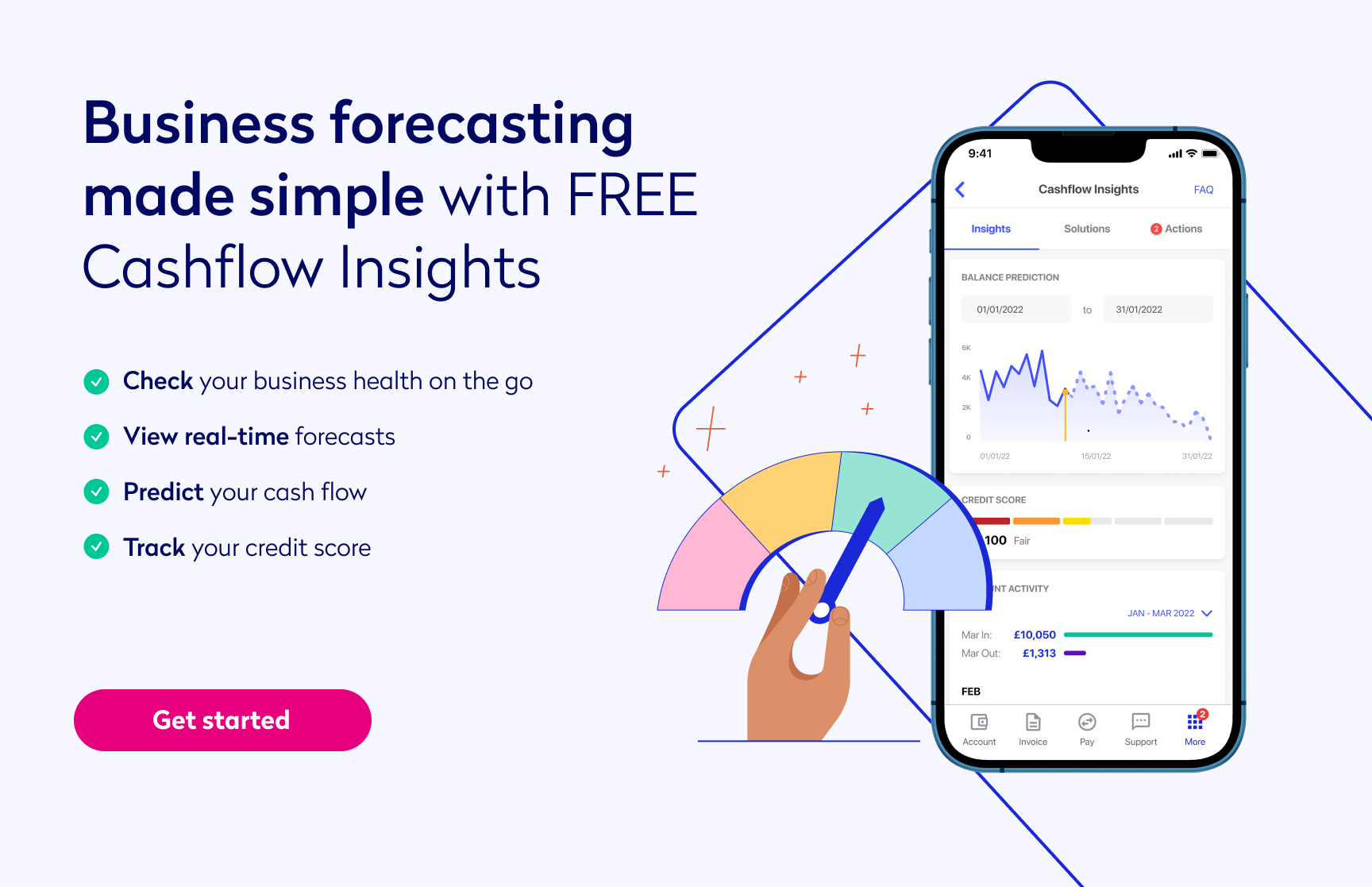

He also highlighted the importance of finding a way to help you better manage your cash flow. We suggest Tide Cashflow Insights: it’s an all-around business tool that gives you real-time cash flow forecasts, boosts your credit score and offers you access to flexible credit options.

WHO am I supplying?

Carrying out checks to better understand your customers and know their status – how credible and active their business is – should be a priority to make sure you get paid what you’re owed.

“Unless you know exactly who you’re supplying, you can’t be sure they’ll pay you. Asking the right questions helps increase your confidence that they’ll be able to pay you and maximises your chances of getting paid on time.”

Philip King, Tide Cash Flow Expert and former Small Business Commissioner

That’s why Philip King believes that accepting nothing, believing nobody and challenging everything makes for a good starting point. He also suggests that you:

- Get beneath the surface and understand the environment in which your customer is operating. Know their name, legal status and financial stability as well as their own customers before you supply them, so you can be confident they’re trustworthy

- Never make assumptions. Just because your customer says they’ll pay you on time doesn’t necessarily mean that they will, or even that they’ll pay you at all

- Use various sources to establish your potential customer’s likelihood of paying you: look at their payment practice reporting data and check if they’re a Prompt Payment Code signatory

- Use a credit-reference agency, talk to other business owners in your sector and even look at your customer’s social media platforms to double-check they’re credible and genuine

WHEN will the customer pay me?

Getting paid on time is crucial for the success of your business. But if you don’t specify the right payment terms for your customers or formally agree on these with them, then you may face late payments, have a poor cash flow and even damage the working relationship.

“Agreeing to payment terms that work for both parties means you’ll be genuine partners. That’s a win-win and makes for healthier cash flow.”

Philip King, Tide Cash Flow Expert and former Small Business Commissioner

To keep yourself out of these situations, Philip advises the following:

- Agree to payment terms and have a policy that establishes a clear course of action for your business’s needs before you supply anyone on credit. And mention this to customers upfront: it’s an essential element of your contractual relationship with them

- Negotiate payment terms that work for both you and your customer. For example, if they ask you to give them longer to pay you back, you could demand a term that benefits you in return. You might ask them to make a bigger order, have fewer delivery points, a longer notice period for terminating the contract or any reason that justifies waiting longer for a payment

- Whatever terms you agree to, always get them in writing, or at the very least have an email trail that sets out what you’ve both agreed on. A documented contract makes sure that all of the terms of the agreement are recorded, and this protects you in case anything fails

WHERE is the money I’m owed?

“Getting invoices paid is key to the survival of a business. It’s vital that, when they aren’t paid on time, you chase them quickly, professionally, and effectively. You need the money in your bank account.”

Philip King, Tide Cash Flow Expert and former Small Business Commissioner

To stay in control of their cash flow, businesses need to know what they’re owned and when. There are many reasons why an invoice may become overdue, but being confident when chasing invoices ahead of time shows professionalism and keeps you free from any trouble that might affect your business.

| 💡 Spend your time helping your business to thrive rather than chasing overdue invoices by using Tide accounting categories and Tide Invoice Assistant. You can categorise all your transactions, and we’ll automatically chase your invoices for you – plus, we’ll match them to the relevant transaction. You can do it all in the Tide app, helping you to get paid even faster. |

We asked Philip for his advice on how to make sure your overdue invoices get paid on time:

- Have a foolproof system to know what invoices are due and when. Whether it’s Tide Invoicing, an Excel spreadsheet, a diary or a scrap of paper, find the approach that works best for you

- If the invoice is big, chase it before it’s due to guarantee your customer has received it and is processing it. You can even get a member of your customer service team to call them and make sure they’ve got all the information they need to pay your invoice. You should always ask for a customer’s contact details before starting to work with them, so you have a contact number in case they stop replying to your emails or letters

- Chase invoices immediately. If you aren’t getting a response, communicate with people who hold more senior positions in the company – LinkedIn can also be a great source

- Be polite, professional, and persistent. If you’re not confident you’re going to be paid, don’t procrastinate: escalate the issue quickly, through a third-party expert if necessary

HOW do I make sure my invoices are processed successfully?

Understanding where your invoices are going and who’s approving them is important to make sure you get paid. You should always take an extra couple of minutes to make sure your invoice is right and has all the information your customer needs to get it processed faster.

“Knowing what the customer needs on your invoices, and how they process them, helps ensure they get approved easily and quickly. If you don’t ask the right questions you may just be throwing invoices over the fence and hoping they land in the right place!”

Philip King, Tide Cash Flow Expert and former Small Business Commissioner

To reduce the risk of getting invoicing wrong, Philip advises you to:

- Make sure you’re sending your invoices under the right company name and to the right address. This saves you the inconvenience of getting paid late, as some companies have a specific location they want invoices to be sent to

- Ask what information your customer needs on your invoice, whether it’s an order number or a particular product description, and make sure these are correct and visible. Businesses usually rely on this information to check their system and match the invoice to an order

- Make sure to set out the invoice due date (here’s a little help on how to streamline your invoice process) and payment terms so that you guarantee they know when and how you want to get paid. Your customer might assume that you want to be paid the same way as other providers or by standard payment terms, which might not be the case

- Find out who has to approve your invoices and what process you have to follow. Ask when they do payment runs and check ahead of time if your payment is included

- Get introduced to the right people in the company so that you can follow up with them if you don’t receive your payment – plus, they might be able to streamline the process for you

Wrapping up

It’s important to communicate effectively with your customers from the beginning and to maintain that communication throughout the business relationship. This is equally as essential as keeping an eye on your cash flow: both will help keep your business healthy and allow it to thrive.

💡 Top Tip: Did you know Tide’s Small Business Tips blog is packed full of handy articles aimed at those who work for themselves? Learn how to create a cash flow forecast, what makes a good business credit score and lots more.

Have your say

What did you think of this series? We’re keen to hear from you – get in touch with us on LinkedIn, Facebook or Twitter.

To find out about upcoming events, take a look at our list of events.

Photo by micheile dot com on Unsplash