How bad credit affects lending: Get a business loan with bad credit

Sufficient cash reserves are crucial for operational expenses such as wages and reinvesting in initiatives that drive growth.

For many companies, these initial cash reserves come in the form of loans from financial institutions. But what if you have bad credit? You may be wondering, “Can I still get a business loan?”

You can still get a business loan, but it’s not as straightforward if you have bad credit.

In this article, we’ll explore how bad credit impacts your ability to access funds and how to obtain a business loan if you do have bad credit.

Table of contents

- What is bad credit and how does it affect business loans?

- How to get a business loan with bad credit

- Expert insights

- Grow fast with a bad credit business loan

What is bad credit and how does it affect business loans?

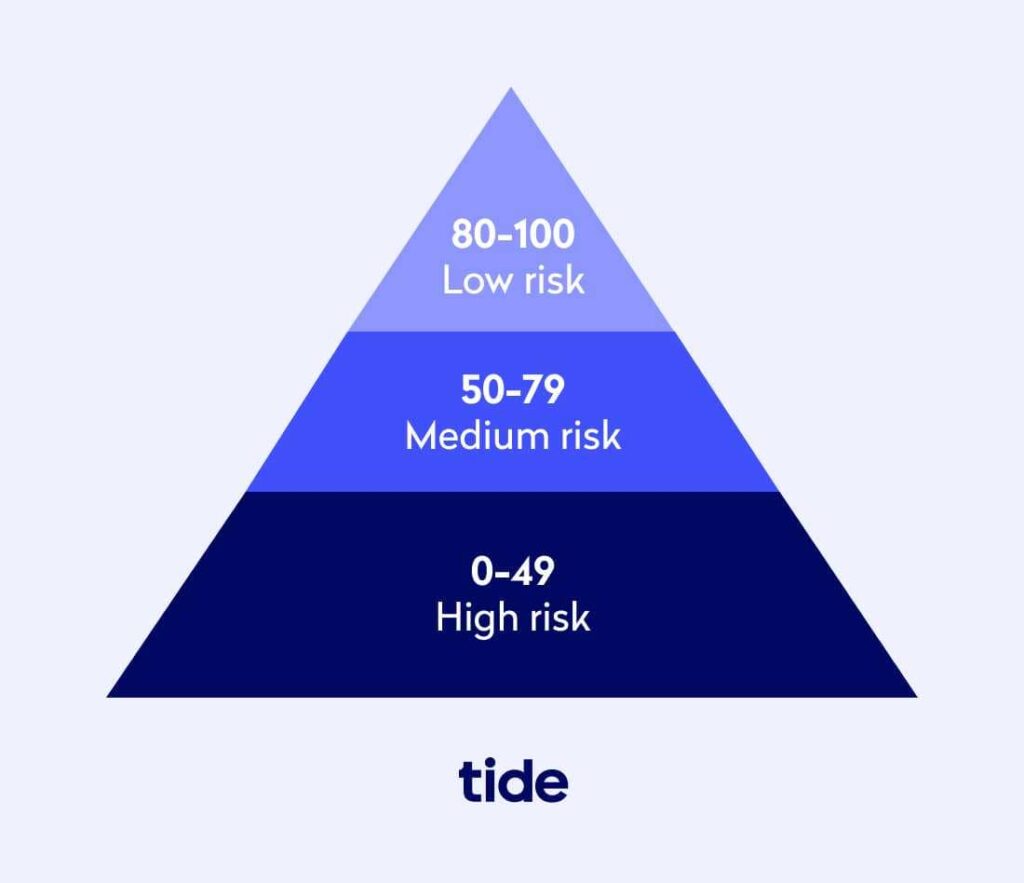

All businesses (and individuals) have a credit score, which is a measure of your creditworthiness. It’s used by lenders to assess risk: higher scores mean lower risk and vice versa.

Business credit is generally scored on a scale from 0 to 100. Your score can roughly be read as follows:

- 80–100 indicates your company is low risk

- 50–79 indicates medium risk

- 0–49 is considered high risk

“Bad credit” is generally considered anything in the high-risk category and some of the medium-risk category.

Your score is based on your credit history. If you’ve had trouble meeting repayment obligations in the past, then it’s likely your credit score will be somewhere in the medium or high-risk range.

Having a poor credit score doesn’t necessarily prevent you from obtaining further funding (such as business loans). It can, however, make accessing finance more difficult and generally more expensive (due to higher interest rates).

We’ll shortly discuss how you might be able to obtain a business loan with bad credit. But first, it’s helpful to understand how lenders perceive credit ratings, as they’re the organisations you’ll ultimately need to convince.

Top Tip: To leverage your credit score and grow your business, you’ll need to know what that number means. Learn more in our guide on what is a good business credit score 🔎

Understanding bad credit from the lender’s perspective

Lenders are essentially investors. They’re putting some money down now (i.e. giving you a loan) and expecting a return on their investment (the interest payments you make).

Like all investments, the payoff must be assessed against risk. Riskier investments should yield higher payoffs, assuming things go well and vice versa.

To put it simply, if a lender perceives more risk (based on your credit score), they’ll want to charge a higher interest rate.

Investors will also try to mitigate risk where possible. Stock market investors use stop-loss orders and hedges to mitigate against risk; lenders ask for more information, guarantees or collateral.

This makes obtaining a business loan with bad credit difficult, but not impossible. This is especially true for businesses that aren’t yet established.

To determine your risk profile, lenders review documents known as credit reports.

Types of credit reports

Before we look at two types of reports that companies might seek about your business, let’s cover hard vs soft credit checks.

A hard credit check is one that a company may carry out when you’re seeking business funding. It’s also usually carried out by utility providers when you apply to use their services. Hard credit checks will appear on your credit report. Too many hard credit checks in a short space of time can hurt your credit score.

A soft credit check is the type of basic check on a few key pieces of information instead of a deep dive into the complete report. For example, if you were to check into your credit score, it would be logged as a soft credit check. Or, if a company wanted to see how successful your application would be before committing to the full application process, they would run a soft credit check.

Soft checks are not visible to other companies on your credit report and they do not affect your credit rating.

In the UK, lenders typically turn to a few major credit reference agencies (CRAs) for reports.

Top Tip: When you understand how the UK credit score system works, you can take the best steps toward your business goals. Learn what’s in a UK credit report and what may be affecting your score in our guide on the UK credit score system 💷

This type of check is considered to be a hard credit check and each has its own purpose and scoring system. Some CRAs focus on investment potential based on financial history (i.e. to ensure the business is likely to pay loans back), while others focus on criminal risk factors (i.e. to ensure it is a legitimate business).

Here’s a look into two reports from top CRAs, what they offer and what you can learn from each.

Experian’s Business Express Credit Check

Experian’s Business Express Credit Check is a credit report you can purchase on any company, including your own. It includes an in-depth credit history for the business, bankruptcy filings, credit scores, credit limits and more. This report is aimed at companies checking into their suppliers, but it’s also a good way to see a detailed report that an investor might purchase about your company.

For less detailed insights into your business’s credit score and its contributing factors, Experian also has a My Business Profile tool.

Equifax’s Commercial Credit Report

Equifax’s Commercial Credit Report is an investigative look at potential “hidden links” to directorships. They’ll do this by cross-referencing contact details with other companies and county court judgments (CCJs) to see where there may be potential risks. The aim of these reports is to detect and combat fraud by sussing out businesses that may be involved in criminal activity.

So, with this information in mind, let’s explore how your company might be able to access a business loan despite a bad credit score.

Can I check my own business credit score?

Yes, businesses can request their own credit score from Equifax, Experian or Creditsafe, three credit reference agencies in the UK.

The process differs based on the CRA you use. For instance, Equifax requires an application form, while Experian offers a My Business Profile subscription to manage your credit score.

Top Tip: Checking your business credit score helps you gauge your lending position. Know where you stand to boost your creditworthiness and secure better financing options, terms, interest rates and more. Learn how in our guide on how to check your business credit score 💻

How to get a business loan with bad credit

First, it’s important to understand the difference between a poor business credit rating and bad personal credit.

A business credit rating shows lenders and potential investors your business’s financial history and helps them determine whether you’re likely to repay your business loans.

A personal credit score, on the other hand, is a rating based on your personal financial history. It takes into account credit extended for non-business reasons—things like personal credit cards, mobile phone contracts or mortgages.

Newer businesses and startups don’t often have enough credit history to establish a strong business credit score. In these cases, lenders may take your personal credit history into account.

That said, if your personal credit score isn’t strong (or you don’t have one at all), it is possible to build your business credit independently of your personal finances.

To reiterate, if you need to apply for a line of credit before you’ve established a good business credit score and your personal score isn’t strong, you still have options.

Let’s explore what you can do to get a business loan with poor or nonexistent credit.

Form a limited company

If your personal credit score is poor, you’ll want to distance your business finances from it. You can do this by incorporating your company.

Forming a limited company separates your business finances from your personal finances, making this an ideal first step toward building good business credit with a bad personal credit score.

Separating your business and personal accounts also protects your personal finances in the case that your business incurs a financial hit (such as a lawsuit). For example, in the event that your company cannot repay a loan, your personal assets (such as your home) won’t be used as leverage.

Top Tip: You can set up a business account and register a limited company at the same time with Tide for only £9.99. Learn more about limited company registration with Tide 🏢

Take out a business credit card

If you’ve registered your business and started trading, you’re eligible to apply for a business credit card. Some business credit cards even offer rewards, such as cashback, insurance discounts or 0% interest on purchases for a set time.

Although all credit card issuers will carry out a credit check, some will approve your application despite a poor personal credit rating. You may have to contend with a higher interest rate or low credit limit to begin with, but this can be negotiated as your company builds a reliable credit rating.

It’s important to note that multiple credit applications can hurt your credit score. This is because lenders will need to submit a “hard enquiry” (which we covered earlier) to learn about your business’s financial history. So, do your research and be selective about which credit card lender to apply to.

A business credit card still works like most personal credit cards in that you must make at least the minimum monthly payments to keep in good credit. But if you can begin your business credit journey by paying off your debts in full each month and avoiding late payment at all costs, you’ll have a better chance of showing investors you can be trusted to pay back their loans.

Get a commercial line of credit

Establishing a line of credit with a bank or lender gives you another opportunity to build a repayment history. The longer your history of making timely repayments, the more your score will increase. A commercial line of credit is often available to businesses for less risky, short-term spending. This could be for buying inventory or managing seasonal payroll surges.

Commercial lines of credit should not be used for large purchases like expensive equipment.

Unless you can pay those bills in full right away, large purchases requiring multiple payments can actually damage your business credit rating.

Do what you can to pay down existing debts

Lenders tend to be more reluctant (or more likely to charge a high-interest rate) when loan applicants have outstanding defaults.

Where possible, do what you can to pay down these debts.

This may be tricky, of course. You’re applying for a business loan because you need capital, so it’s likely that your ability to pay down existing debts immediately is limited.

In this case, consider entering into a repayment agreement with your existing lenders. This agreement can be used as proof of commitment to strong financial habits moving forward and may be seen favourably by lenders.

Top Tip: Increasing your credit score is the best way to access funding with more favourable terms, but it’s not something you can do overnight. Learn the steps to take toward a better rating in our guide on how to increase your business credit score 🔧

Understanding your credit options

If you’re considered a high-risk applicant (i.e. your credit score is particularly low), it’s possible that some traditional lenders won’t entertain your application.

There is, however, more than one type of loan available and certain lenders offer a number of finance options for small business owners.

Secured loans

Secured loans use some form of an asset as collateral for the loan. This may include business assets, though most commonly, it’s personal property.

If you’re unable to meet your repayment obligations, this asset may be seized by the lender. As such, it presents more of a risk to you, the borrower, but may enable you to access lending at lower interest rates.

Unsecured loans

Unsecured business loans are the opposite of secured loans; there is no collateral or security against the loan. These loans are based on creditworthiness alone.

With unsecured loans, the lender is taking on more risk. This means they’ll likely charge a higher interest rate and deploy collections agencies if the borrower defaults on repayments (instead of taking the value from the collateral, as in secured loans).

No credit check loans

No credit check loans (often referred to as bad credit business loans) are designed specifically for companies with a poor credit history.

In this case, the lender doesn’t run a credit check (so your history won’t be taken into account). Interest rates tend to be high for this kind of loan, and the lender may require more in-depth information such as a startup business plan before agreeing to lend to you.

Guarantor loans

Guarantor loans bring another party into the contract, asking them to provide a personal guarantee that if your business is unable to repay its debt, they’ll take on the burden.

Peer-to-peer lending

Peer-to-peer lending is as it sounds, you’re receiving a loan from another individual or business rather than through a bank or other financial institution.

These loans are generally facilitated through dedicated peer-to-peer lending platforms. Interest rates and loan requirements vary.

Credit unions

Credit unions are similar to banks, except that they are not-for-profit. This means they’re often more interested in providing more favourable terms for borrowers, so they can be great places to secure small business loans if you have poor credit.

Don’t apply everywhere

Too many hard inquiries on your credit report are seen as unfavourable by lenders and impact your eligibility to borrow.

Rather than applying everywhere you can, spend some time researching various institutions, then build a hierarchy of preferred lenders.

Some lenders may provide details on the kinds of risk they accept and in some cases, you may be able to access reviews from previous borrowers.

Apply for as small a loan as possible

At low rates, large loans are more digestible. High interest rates push your repayments up, however, making meeting your financial obligations more difficult.

Lenders also perceive larger loans as higher risk, meaning asking for a smaller loan amount may earn you a more favourable interest rate.

Opt for shorter-term lending

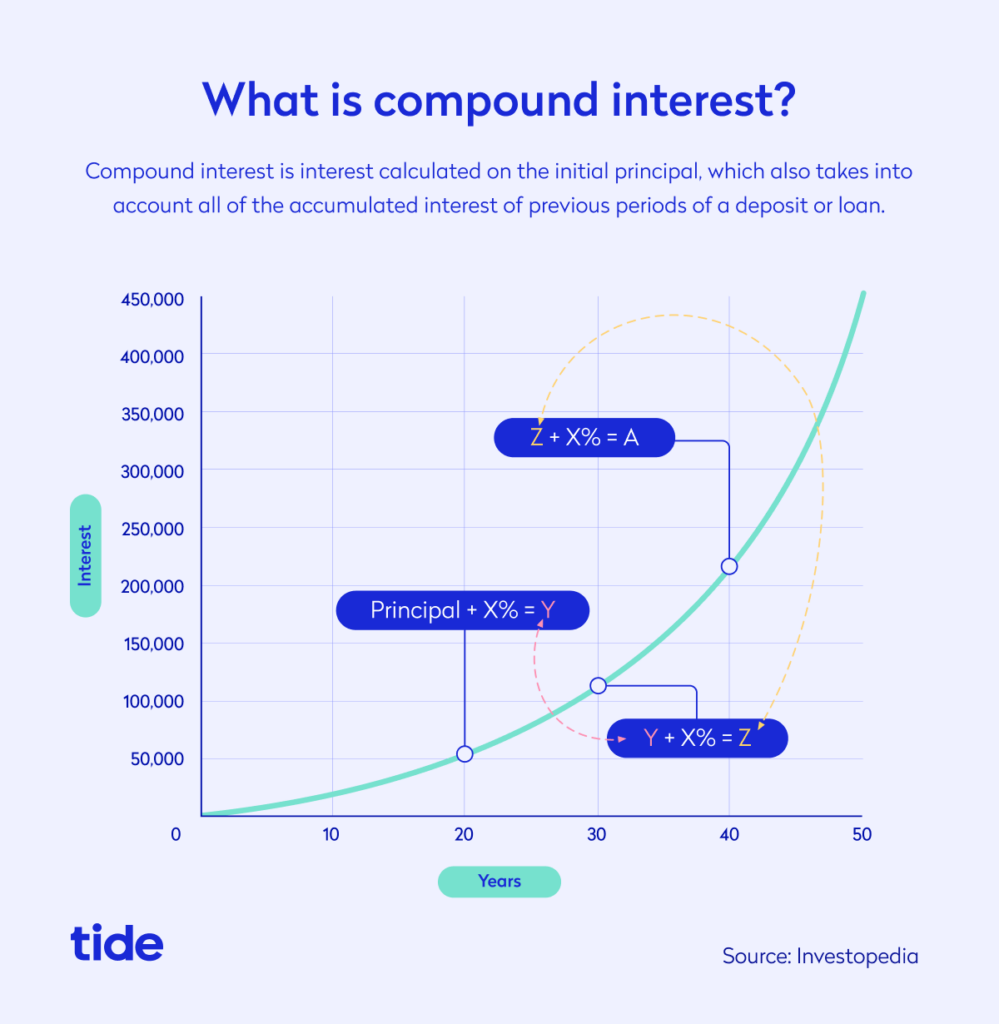

The length of your loan also has a significant impact on your total repayment amount due to compounding interest.

A simple interest rate is calculated only on the principal amount. For example, a 5% simple annual interest rate calculated on a £10,000 credit card debt over three years would mean you pay a total of £1,500 in interest. Each year, you’d pay £500 in interest.

However, compound interest rates are more common. With these rates, you pay interest and interest on your interest.

For example, let’s say you have a £10,000 loan at an interest rate of 5% that compounds annually for three years. In this case, you would pay around £1,576 in total interest.

If we take the same example but the interest rate compounded monthly, you would pay approximately £1,615.

Note: These examples are simplified situations, not taking regular payments toward the balance into account.

For both types of interest rate, the longer the loan term, the more interest you pay. But with compounding interest rates, your interest increases exponentially over time (and your monthly payments will vary).

Not only will you pay less interest with a shorter term loan, the interest rates themselves may be favourable for short-term loans.

Rather than accessing a large loan over a five-year span, reduce your loan application amount and term. Pay off that one-year loan (which gives you the time and ability to improve your credit score), then apply for another one down the road.

You’ll save on interest and you’ll likely receive more favourable terms across the span of your borrowing.

💡 Expert insights

As Tide’s Cash Flow Expert and, with over 40 years experience of credit management, Philip King is passionate about cash flow and supporting small businesses.

Previous roles he has held include that of Interim Small Business Commissioner for the UK Government during 2020 and 2021. This involved providing support and advice to small businesses on their trading relationship with customers, particularly in respect of payment issues. As the Chief Executive of the Chartered Institute of Credit Management between 2005 and 2020, he also promoted the importance of effective cash flow management across industry by working with small businesses to improve their payment performance.

Q1: Why is my personal credit history relevant to getting business credit?

If you haven’t yet built up a business credit score, then it’s all a supplier can look at when deciding whether or not to offer credit terms. But even if your business has a reasonable credit score, a prudent supplier might still look at your personal credit profile.

People who are careless in managing their personal finances often tend to be similarly careless in dealing with business expenses and finance. A supplier wants to be confident that you’re going to be a valuable, reliable, and prompt-paying customer. If you have a personal history of missed payments then they won’t have the confidence they need and will be more reluctant to offer the credit facilities you seek.

Firstly, it’s worth managing your personal finances as well as you can and, secondly, it’s important to build up a positive business credit rating. If the business builds up an exemplary record then suppliers will be less likely to delve into your personal history.

Q2: I’m a micro-business and currently pay immediately for whatever my business needs so why should I worry about my business credit score?

Whatever your business does, it’s likely to sometimes need to buy things that take time to turn back into cash. If you’re buying stock to re-sell, materials or products that are needed to perform a service, or even office equipment that will pay dividends through ongoing efficiency, there is likely to be a time-lag between procuring the goods or services and generating cash from them.

In the early days this might not be significant but, as your business grows, it will become a bigger issue and you might need to fill the resulting gap in cashflow. Getting credit from a supplier is often cheaper and easier than obtaining funding from other sources. If and when you ask for a credit account, having a good business credit score will make the supplier more likely to offer you payment terms and to offer you a larger amount of credit.

Q3: What are the easiest first steps to building a good business credit score?

There are several steps outlined in this article and they all work. Get a business credit card and use it for everyday business expenses. As you pay the balance off each month, your credit score will reflect the positive payment behaviour even if the amounts involved are minimal.

Ask one or two suppliers to give you a credit account. Pay their invoices promptly and you will be building a reputation as a good customer, you’ll have suppliers who can give you a positive trade reference, and you’ll be in a stronger position when a greater need arises.

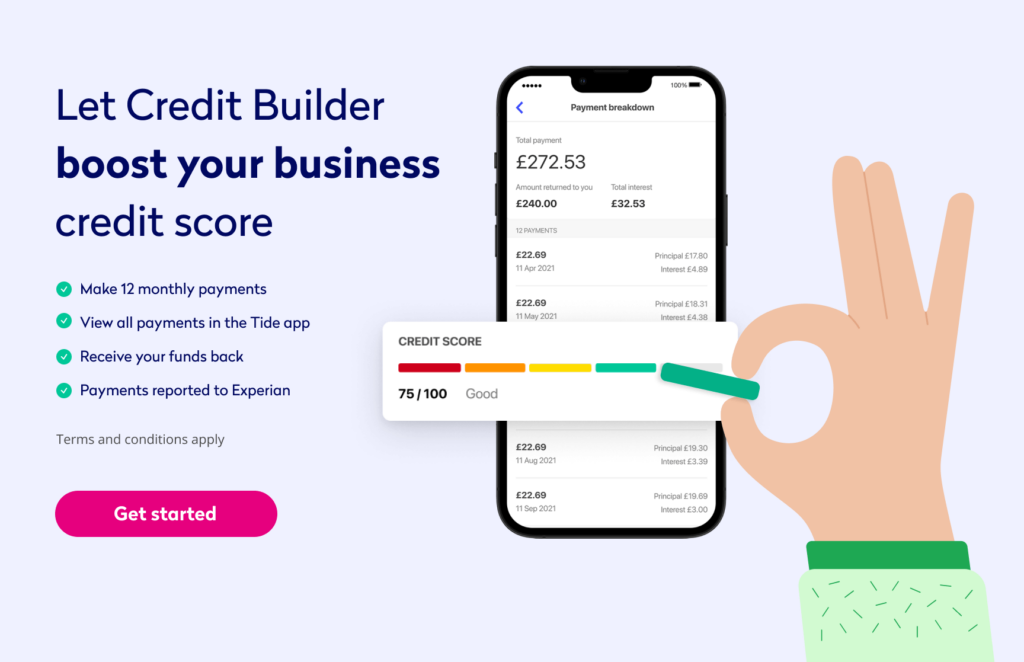

Take a look at Tide’s Credit Builder. This is a really clever tool that allows you to transfer modest amounts of money into a holding account that will generate a track record of positive payment behaviour and create a positive credit score to support the growth and development of your business.

Grow fast with a bad credit business loan

Obtaining a business loan with poor credit history is far from impossible.

Though interest rates may be higher than traditional lending, you still have plenty of options for securing funding to grow your business.

Where possible, make efforts to improve your credit score by paying down existing debts, separating your personal and business ratings by forming a limited company or securing a commercial line of credit.

Ready to take action?

Tide has a number of products to help you predict your cash flow so you can more easily access business credit. To boost your credit score and improve your business’s financial health, explore Tide Cashflow Insights.

Boost your business credit score with Tide Credit Builder

Give your company credit rating the chance to grow. Make 12 easy monthly payments. Track your progress in the Tide app anytime. We’ll report your payments to Experian to help grow your business credit score. Get your funds back at the end of the year. Help boost your credit score with Credit Builder today! 🚀

Photo by krakenimages, published on Unsplash