5 free Tide features that help digitise your small business

In an increasingly digital world that’s only been accelerated by the pandemic, both your customers and competitors are spending more and more time online. That’s why it’s so important for you to adapt your business, so you don’t get left behind.

But where to start? At Tide, we’re all about saving you time and money, which is why we’ve broken down what digital transformation is and how you can use your Tide membership to achieve it. By taking advantage of these features, you’ll get more time back to do the work you love 🚀

Table of contents

What is digital transformation?

Digital transformation is when a business starts using digital technology to improve the way it operates. It can open up opportunities to reach new customers and markets, boost productivity and improve longevity for businesses in all sectors. In fact, 1,000 surveyed UK companies reduced costs by 4.3% and increased revenue by 4.4% by increasing their digital capabilities.

The Department for Digital, Culture, Media and Sport has identified four main digital activities that businesses need to stay competitive:

- Maintain a web presence

- Sell online

- Use the cloud (storing information and documents in secure online data centres)

- Digitise back-office functions such as finance

How to digitise small business finance admin

From free tools to affordable add-ons, here are 5 Tide features to help you digitise – without the need for third-party software.

1. Automate financial forecasting

A cash flow forecast predicts how much money will flow in and out of your business. It’s an important tool to use when making business decisions; it alerts you to potential ups and downs in cash flow which could affect your ability to pay taxes, salaries and other charges. It’s usually made up of three spreadsheets: a sales forecast, a profit and loss statement and a cash flow forecast.

Free Cashflow Insights gets rid of those spreadsheets for you 🙌

- Auto-predict your cash flow: View real-time forecasts based on your account activity in an easy-to-read graph. We’ll predict your balance up to 30 days ahead and send you instant alerts if any cash flow problems pop up

- Access credit options: See tailored funding options that you’re already eligible for, to help you fill a cash flow gap or support business expansion (additional eligibility checks may be run when applying for Tide’s partner products)

- Grow your credit score: Track and improve your credit score using the embedded Experian Credit Score tool. You’ll get real-time updates if it increases or decreases, too. If you need a hand improving your credit score, our Credit Builder feature can help build it up in 12 months, for under £33

If you’re a Tide member, tap More > Cashflow Insights in your Tide app or Tide on the web to get started. Non-Tide members can benefit from Cashflow Insights too, by connecting their current bank account to Tide through Open Banking.

2. Prepare for Self-Assessment digitally

As the Self-Assessment deadline approaches each year, a feeling of dread sets in for many small business owners across the nation. It’s always best to get ready for your tax return in advance to avoid costly penalties and unnecessary stress.

One way to prepare is to keep your expenses organised. Thanks to our free-to-use smart accounting categories, you can organise your income and expenditure into categories that match up with the exact category names on HMRC’s SA103F Self-Assessment form. That way, you can easily copy the figures into the corresponding boxes when you’re filling the form in online or on paper 🎉

3. Store receipts in the cloud

Imagine being in a situation where you need to find a receipt urgently, and the only way to find it is to trawl through piles and piles of old ones. That’s a nightmare for even the most organised business owners. Plus, with the risk of them being lost, thrown away, stolen or damaged during adverse weather such as flooding, it’s important to digitally back up your receipts ✅

That’s where our free Receipt Importer comes in. You can securely upload your receipts in your Tide app or Tide on the web as you get them or in bulk (up to 5 at a time using the app), so you won’t lose hours to mistake-prone data entry. You can add a note and automatically match them to the relevant transactions, too. Then, download your receipts at any time via Tide on the web, making it easier to complete tax and expense-related tasks or share them with your accountant.

Watch how Receipt Importer works in 45 seconds:

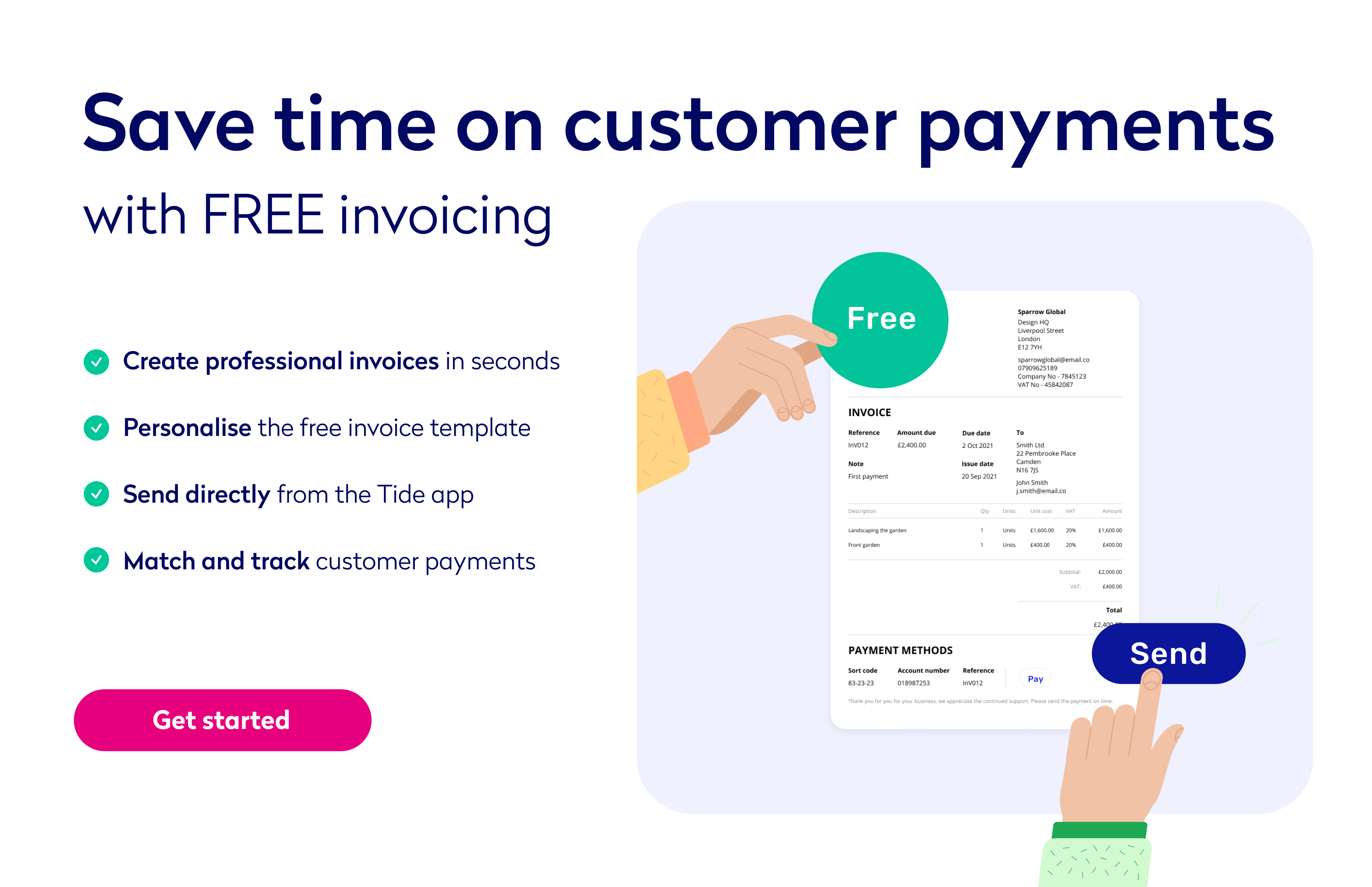

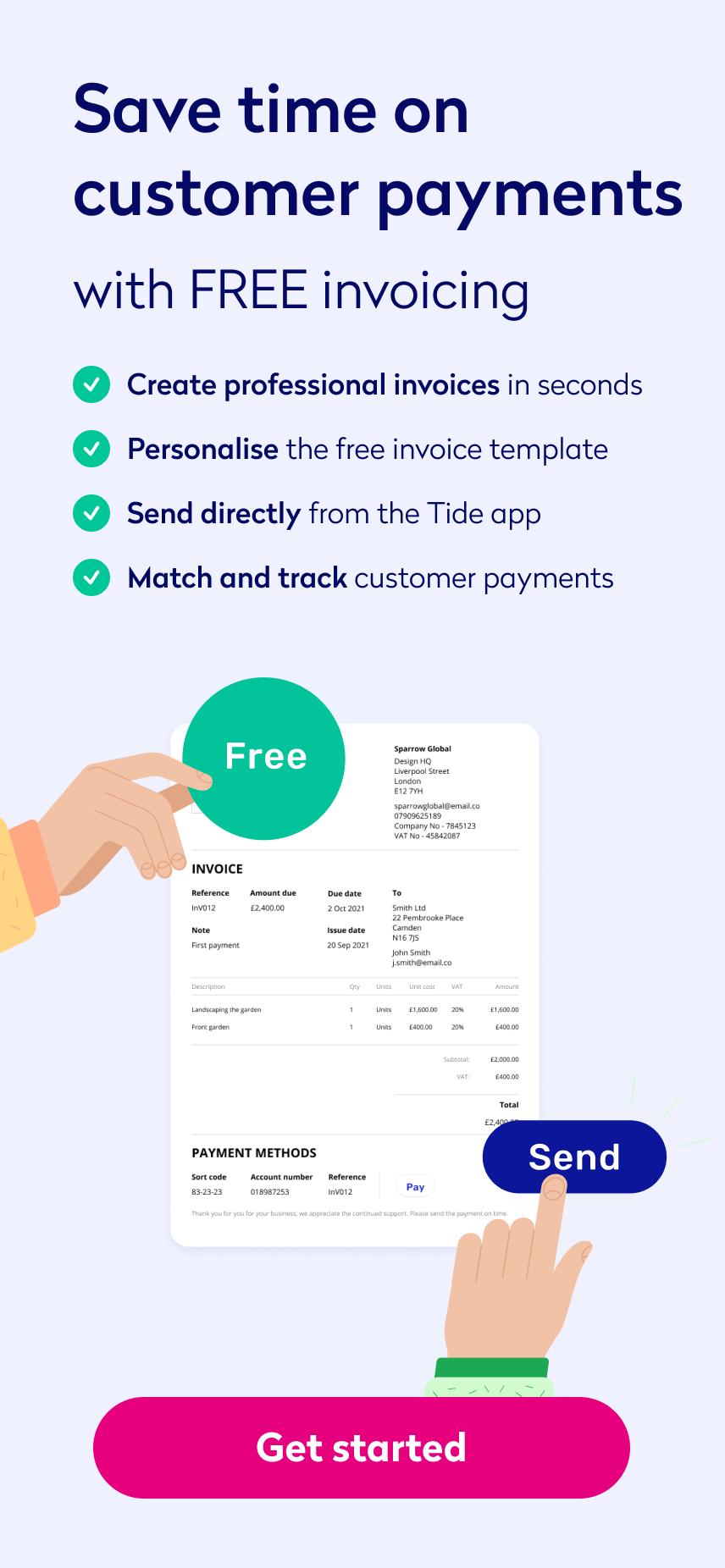

4. Implement online invoicing

An invoice lets your customer know how much they owe you, when they need to pay it by and how to pay. It’s a record of any goods or services you’ve provided and is a professional way to bill your customers 🔥

However, our research found that the average UK SME wastes 1.5 hours every day chasing an average of 5 overdue invoices. Our free, built-in Invoicing tool lets you create, send and track invoices straight from your Tide app. Plus, for £10 + VAT per month, Invoice Assistant automatically chases overdue invoices for you.

Select Invoice in your Tide app or Tide on the web to start sending free invoices. You can upgrade to Invoice Assistant there too – just go to Invoice > Manage > Features > Get Invoice Assistant.

5. Manage team expenses online

From new team software to travel costs for business trips, there are plenty of costs your employees cover on a regular basis that you need to reimburse them for. However, paper expense claim forms can be time-consuming and increase the potential for error and fraud. Not to mention, it can be confusing to keep track of them throughout the year so you can claim them back as allowable expenses on your Self-Assessment tax return.

Tide Expense Cards help you get rid of even more paperwork and give your team the flexibility to make purchases from your account 👌 Not just that – you can also set spending limits, track purchases through real-time updates and auto-match receipts to transactions.

Tide Plus members get one free Expense Card, whilst Tide Cashback members get three free Expense Cards. If you’re on a free plan or want any additional cards outside of this allowance, they cost £5 + VAT per card per month. Order Expense Cards by going to More > Expense Cards in your Tide app or Tide on the web.

Wrapping up

Each small step you take towards digital transformation will pay off in long-term time and manpower savings. The Tide features we’ve gone through above are easy to set up, with no technical knowledge required! They’re all available in your Tide app and Tide on the web too. That means you won’t need to take on massive costs or waste time getting to grips with third-party software.

Photo by Nikita Vantorin, published on Unsplash